NO.PZ2022122601000064

问题如下:

The SCI risk premium, equal to the SCI return minus the risk-free rate, denoted as SCIRP, is used as the dependent variable in a two-factor regression in which the independent variables are index returns minus the risk-free rate for the consumer credit industry (CCIRP) and the telecommunications industry (TELIRP). The regression results are in Exhibit 2.

Although volatility information is available from the SCI data and correspondingly for the SCIRP, Li’s team wants to determine the statistical relationship between the SCIRP and both the CCIRP and the TELIRP because forecasting the CCIRP and TELIRP is much less difficult than forecasting the SCIRP. After some discussion, the team believes that the volatility measure for the SCIRP data based on the volatility of CCIRP and TELIRP through the regression should be adjusted to incorporate a correlation coefficient of 0.25 between the CCIRP and TELIRP. Although the two index risk premiums were uncorrelated in the past and within the regression, Li’s team believes the two technologies will become more correlated in the future.

Based on the correlation that Li's team believes to exist between the CCIRP and TELIRP, the new volatility for the SCIRP is closest to:

选项:

A.31.8%

解释:

Correct Answer: B

Begin with: Var (M) = Var (F1)× (b1)2 + Var (F2) × (b2)2 + 2 × b1 × b2 × Cov (F1, F2) +Var (ε).

Find the variance of the error term using values from Exhibit 2:

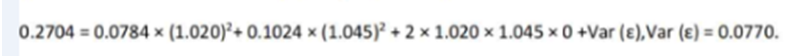

0.2704 = 0.0784 × (1.020)2+ 0.1024 × (1.045)2 + 2 × 1.020 × 1.045 × 0 +Var (ε),Var (ε) = 0.0770.

The adjustment is stated as being a correlation of 0.25.

Change the

correlation into a covariance:

Cov(F1,F2) = Corr(F1,F2) × Std Dev (F1) × Std Dev (F2)= 0.25 × (0.0784)^0.5 × (0.1024)^0.5 = 0.0224

The volatility of SCI after adjusting for the correlation is0.3181^0.5=56.4%

中文解析:

Var (M) = Var (F1)× (b1)2 +Var (F2) × (b2)2 + 2 × b1 × b2 × Cov (F1, F2) +Var (ε)。

使用表2中的值找到误差项的方差:

0.2704 = 0.0784××0.1024(1.020)2 +(1.045)2 + 2×1.020×1.045×0 + Var(ε),Var(ε)= 0.0770。

调整的相关系数为0.25。

将相关性转化为协方差:

Cov(F1,F2) = Corr(F1,F2) × Std Dev (F1) × Std Dev (F2)= 0.25 × (0.0784)^0.5 × (0.1024)^0.5 = 0.0224

经相关系数调整后的上证综指波动率为0.3181^0.5=56.4%

按照题目中给出的条件,我们是否可以写出回归公式如下:

5.4%=0.011+1.02*4.6%+1.045*2.8%+残差项

根据这个公式可以求出残差项的值?为什么不对?