NO.PZ201909280100000905

问题如下:

The opportunistic strategy that Mukilteo considers

is most likely to be described as a:

选项:

A.

global macro strategy

B.

time-series momentum strategy

C.

cross-sectional momentum strategy

解释:

C is correct. The

strategy under consideration is a managed futures strategy—specifically, a

cross-sectional momentum approach. Such an approach is generally implemented

with securities in the same asset class, which is corporate bonds in this case.

The strategy is to take long positions in contracts for bonds that have risen

the most in value relative to the others (the bonds with the narrowing spreads)

and short positions in contracts for bonds that have fallen the most in value

relative to the others (the bonds with the widening spreads). Cross-sectional

momentum strategies generally result in holding a net zero or market-neutral

position. In contrast, positions for assets in time-series momentum strategies

are determined in isolation, independent of the performance of the other assets

in the strategy and can be net long or net short depending on the current price

trend of an asset.

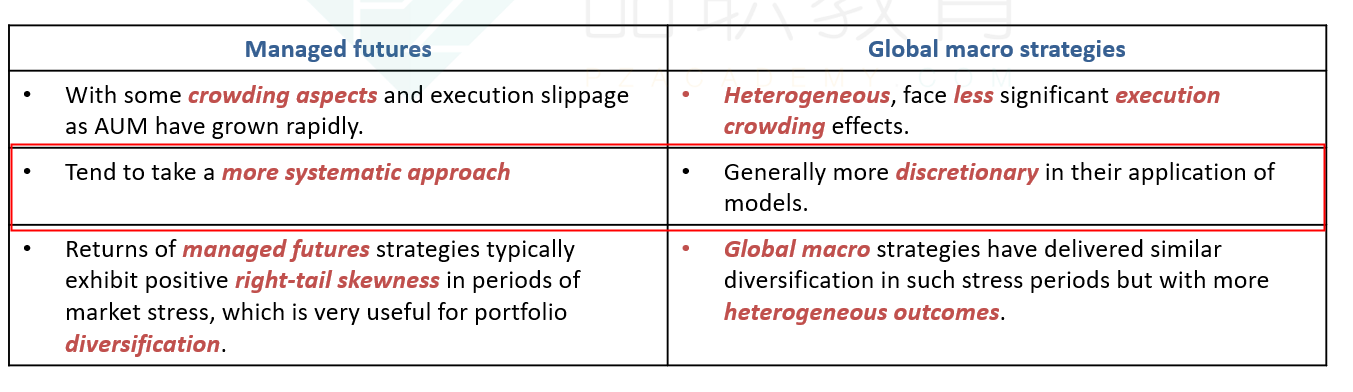

A is incorrect

because the opportunistic strategy under consideration is more likely to be

described as a managed futures strategy—specifically, a cross-sectional

momentum approach—rather than a global macro strategy. Global macro strategies

are typically top down and generally focus on correctly discerning and

capitalizing on trends in global financial markets, which does not describe the

strategy under consideration. In contrast, managed futures strategies that use

a cross-sectional momentum approach are implemented with a cross-section of

assets (generally within an asset class, which in this case is highly rated

corporate bonds) by going long those that are rising in price the most and by shorting

those that are falling the most.

B is incorrect

because the strategy under consideration is a managed futures

strategy—specifically, a cross-sectional (not time-series) momentum approach.

Time-series trading strategies are driven by the past performance of the

individual assets. The manager will take long positions for assets that are

rising in value and short positions for assets that are falling in value.

Positions are taken on an absolute basis, and individual positions are

determined independent of the performance of the other assets in the strategy.

This approach is in contrast to cross-sectional strategies, where the position

taken in an asset depends on that asset’s performance relative to the other

assets. With time-series momentum strategies, the manager can be net long or

net short depending on the current price trend of an asset.

这个题要抓核心关键词,首先是opportunistic strategy,然后看到下面的market neutral,就要联想这个策略里market neutral的是哪个?

老师 为什么不是global macro