NO.PZ202210140200000104

问题如下:

An estimate of the ERP consistent with the Grinold-Kroner model is closest to

选项:

A.2.7%

3.0%

4.3%

解释:

B is correct.

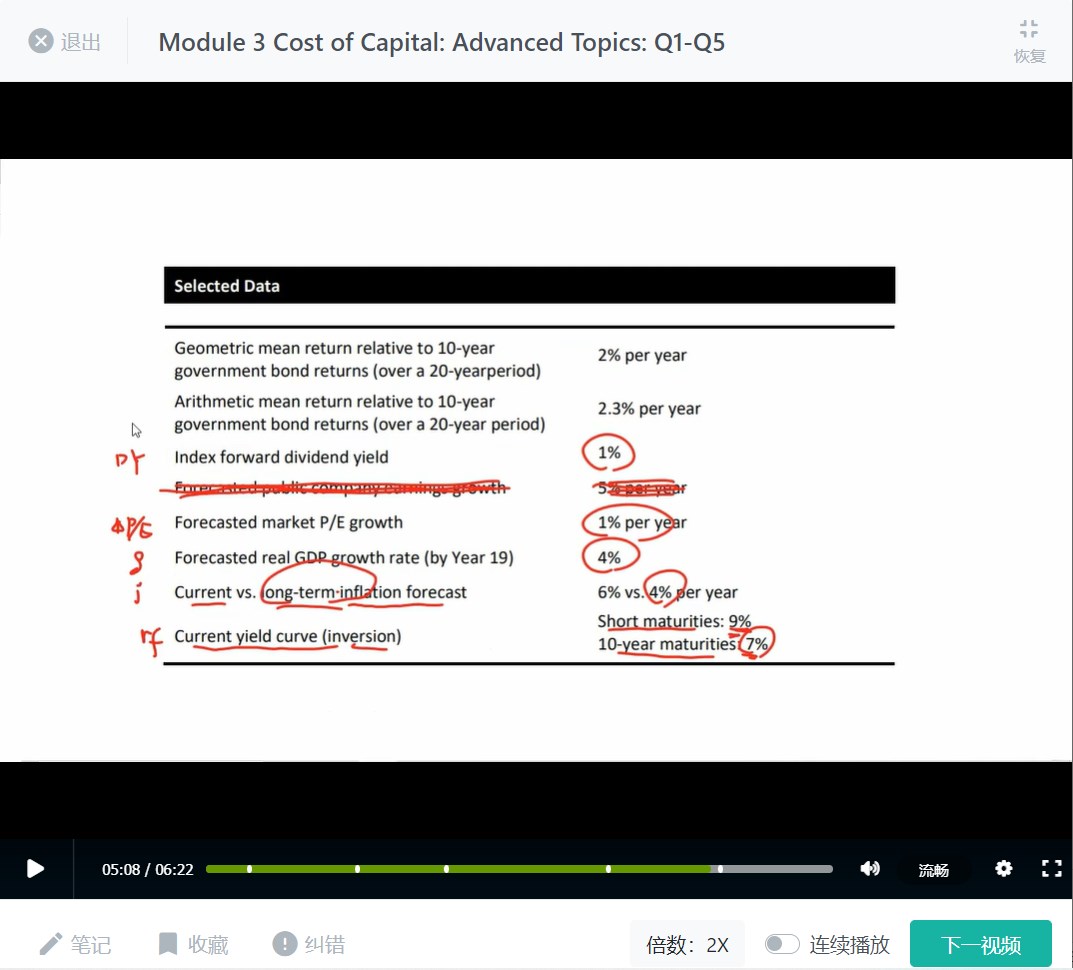

i = 4% per year (long-term forecast of inflation)

g = 4% per year (growth in real GDP)

Δ (P/E0 = 1% per year (growth in market P/E)

dy = 1% per year (dividend yield or the income portion)

Risk-free return = rf = 7% per year (for 10-year maturities)

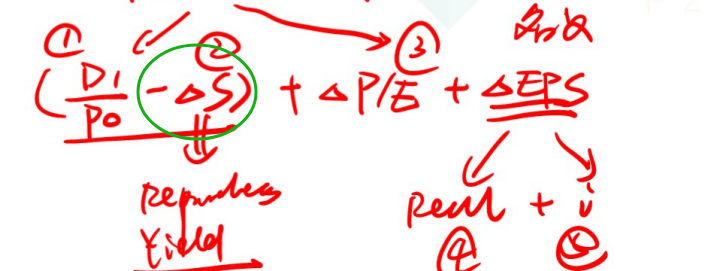

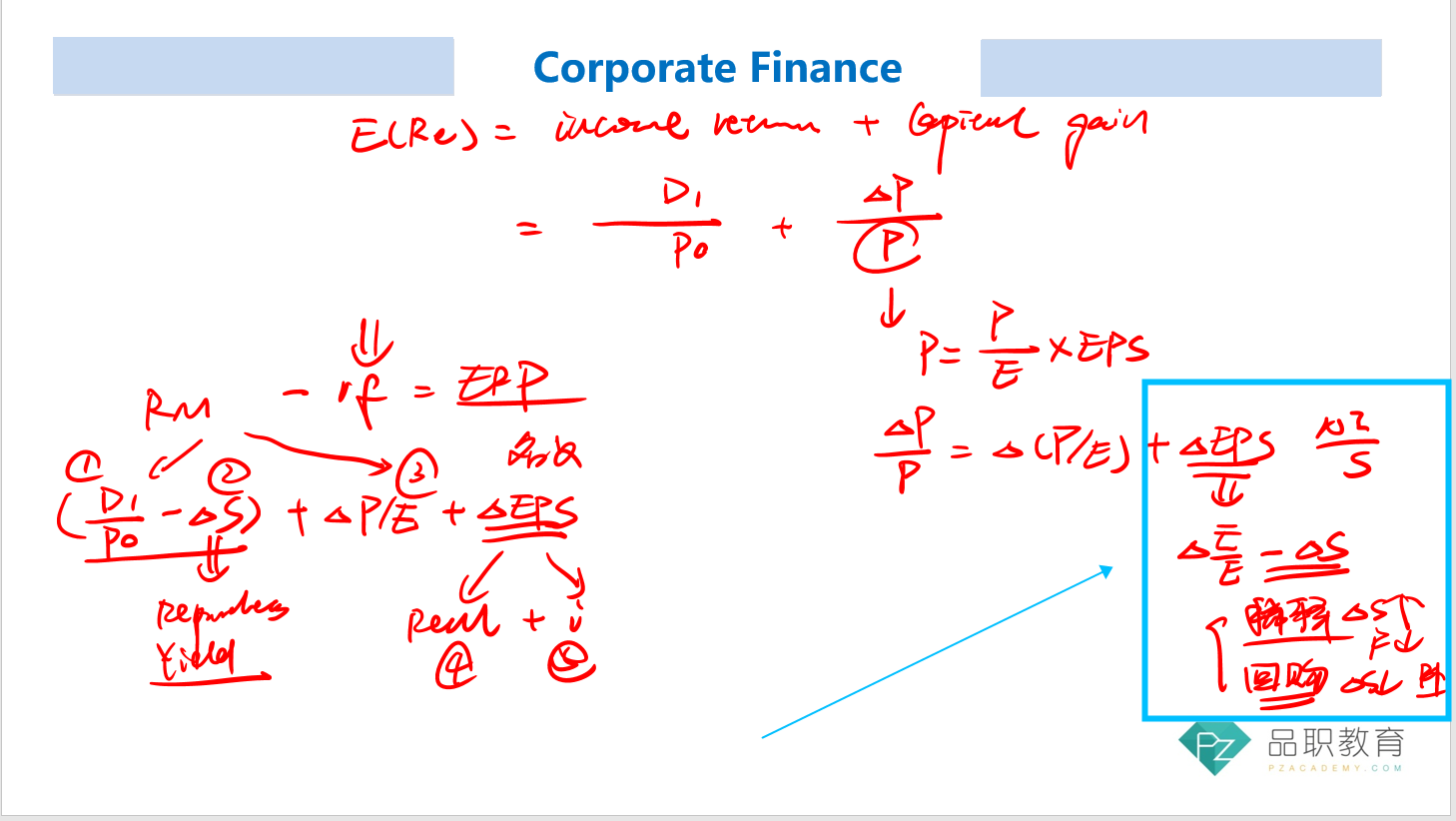

Using the Grinold-Kroner model, the ERP estimate is

ERP = {1.0 + 1.0 +[4.0 + 4.0 + 0.0)] } – 7.0 = 3.0%.

The premium of 3.0% compensates investors for average market risk, given expectations for inflation, real earnings growth, P/E growth, and anticipated income.

1、g为什么不能选择Forecasted public company earnings growth?使用企业增长率会否更合适?

2、对△s的加减不明确,代表的是股份增加数还是股份回购数?请针对考试提供简单明确的判断方法