NO.PZ2023040301000110

问题如下:

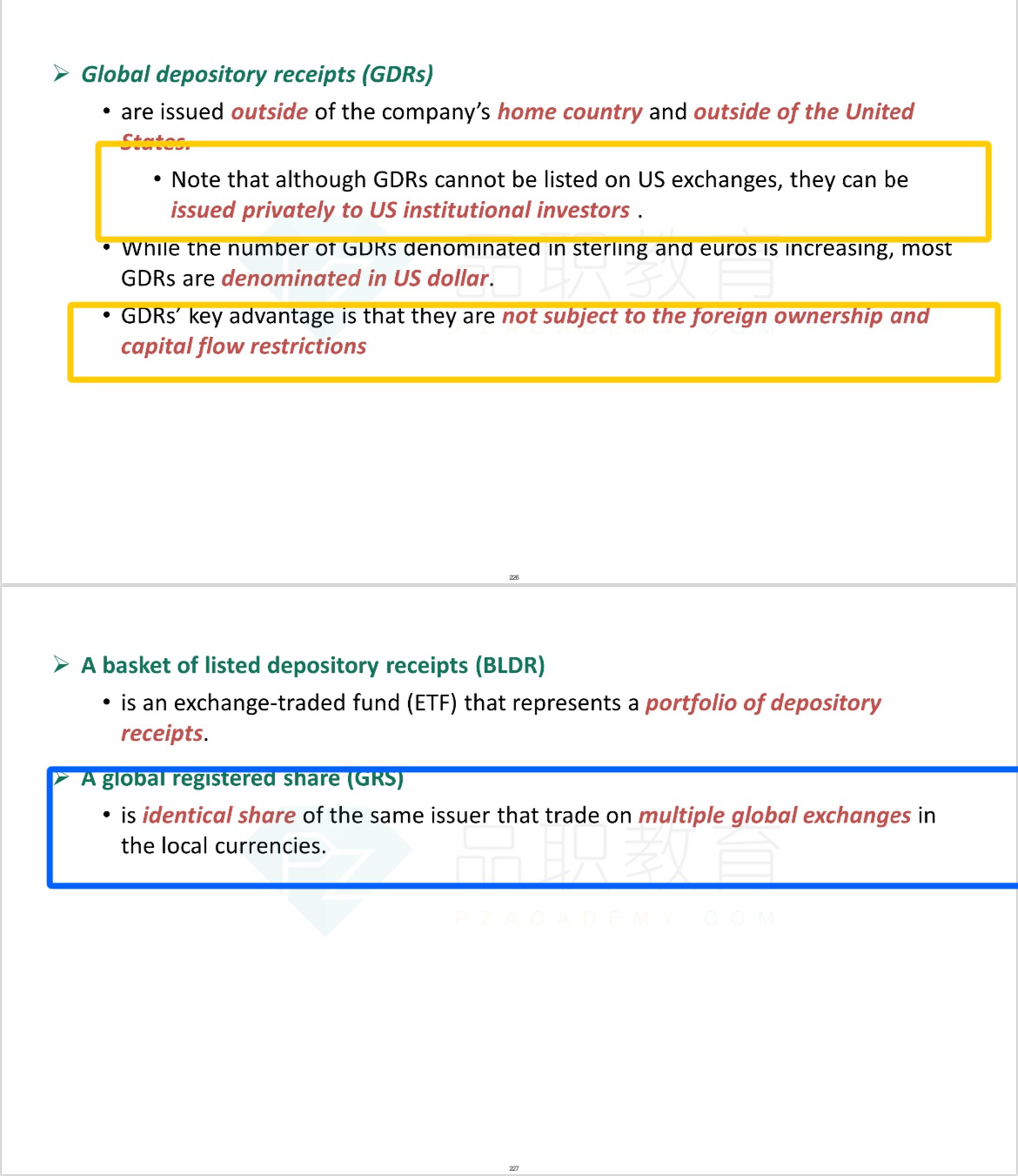

A U.S. institutional money manager prefers to invest in depository instruments of non-domestic equity securities that are privately placed in the U.S. and not subject to the foreign ownership and capital flow restrictions. The type of security that is most appropriate for this investor is:

选项:

A.global registered shares

global depository receipts

American depository shares

解释:

Global depository receipts (GDRs) meet the investor preferences. They are not subject to the foreign ownership and capital flow restrictions that may be imposed by the issuing company’s home country because they are sold outside of that country. GDRs cannot be listed on U.S. exchanges, but they can be privately placed with the institutional investors based in the United States.

为什么选b呢。。。