NO.PZ2023081403000147

问题如下:

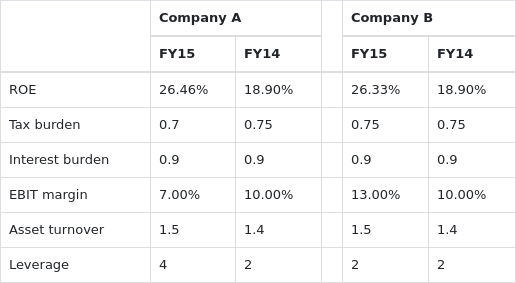

Q. A decomposition of ROE for Company A and Company B is as follows:Exhibit 1:

ROE for Company A and Company B

An analyst is most likely to conclude that:

选项:

A.Company A’s ROE is higher than Company B’s in FY15, and one explanation consistent with the data is that Company A may have purchased new, more efficient equipment. B.the difference between the two companies’ ROE in FY15 is very small and Company A’s ROE remains similar to Company B’s ROE mainly due to Company A increasing its financial leverage. C.Company A’s ROE is higher than Company B’s in FY15, and one explanation consistent with the data is that Company A has made a strategic shift to a product mix with higher profit margins.解释:

B is correct. The difference between the two companies’ ROE in FY15 is very small and is mainly the result of Company A’s increase in its financial leverage, indicated by the increase in its Assets/Equity ratio from 2 to 4. The impact of efficiency on ROE is identical for the two companies, as indicated by both companies’ asset turnover ratios of 1.5. Furthermore, if Company A had purchased newer equipment to replace older, depreciated equipment, then the company’s asset turnover ratio (computed as sales/assets) would have declined, assuming constant sales. Company A has experienced a significant decline in its operating margin, from 10 percent to 7 percent which, all else equal, would not suggest that it is selling more products with higher profit margins.

这道题怎么解读啊