No.PZ202209060200004406来源: Handbook

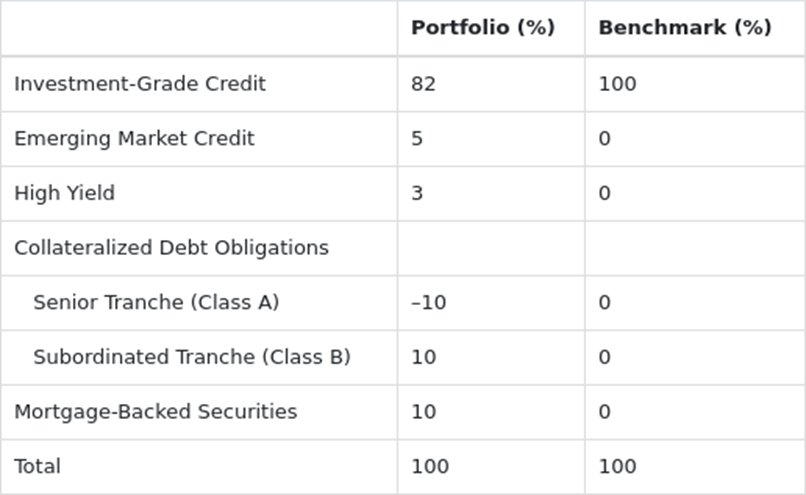

Choate’s final comments to Hale detail how he also looks for structured financial instruments that offer diversification benefits and attractive expected returns. These are listed in Exhibit 1, which shows recent COF portfolio positioning relative to the benchmark and reflects various opportunities Choate has uncovered across several markets.

Exhibit 1

COF Portfolio Holdings as of 12/31/xx

Based on Choate’s final comments and the COF portfolio positions in Exhibit 1, Choate is most likely expecting:

您的回答C, 正确答案是: B

A

improved real estate markets and higher interest rate volatility.

B

lower interest rate volatility and increasing default correlations.

C

lower interest rate volatility and decreasing default correlations.