NO.PZ201704060100000302

问题如下:

Based on the given assumptions and the data in Exhibit 1, the additional amount of life insurance coverage needed is closest to:

选项:

A.A$0.

B.A$331,267.

C.A$2,078,101.

解释:

B is correct.

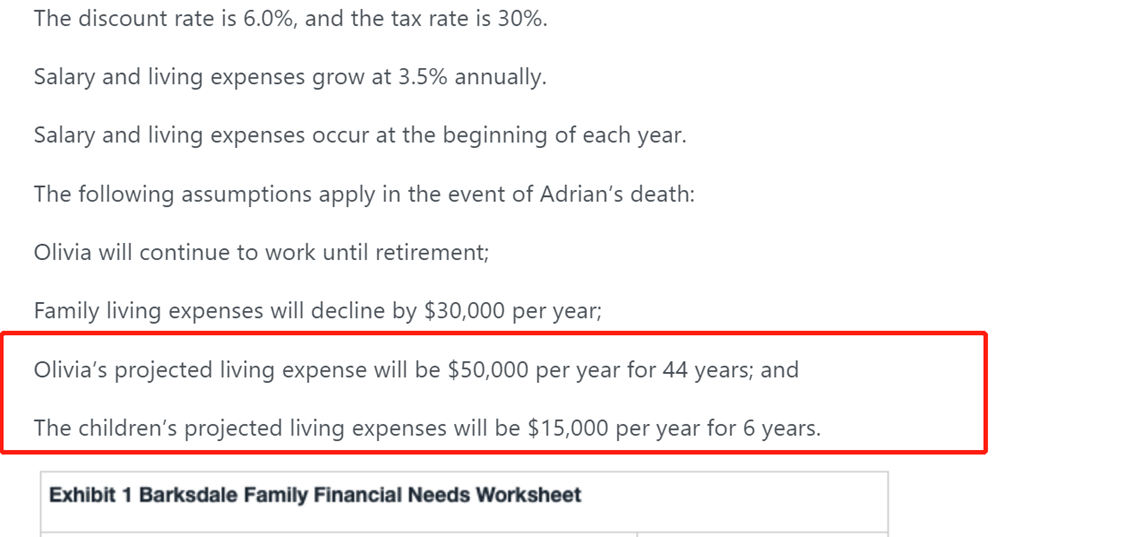

The additional amount of life insurance coverage needed is calculated as the di₤erence between the family’s total financial needs and total capital available. Total financial needs are calculated as follows.

Capital needs are determined as the present value of an annuity due: growth rate = 3.5%, discount rate = 6.0%. Growth of payments is incorporated by adjusting the discount rate to account for the growth rate of earnings. As long as the discount rate is larger than the growth rate, the adjusted rate i can be calculated as follows: [(1 + Discount rate)/(1 + Growth rate)] – 1, or i = (1.06/1.035) – 1 = 2.42%.

1、family expense是95000,且每年下降3000,那么每年的PMT要减3000,一共要减去多少年

2、为什么在本次计算中,不考虑family expense