NO.PZ2022083003000004

问题如下:

Which of the following is NOT a typical way in which asset managers integrate ESG?

选项:

A.

Using ESG as a threshold requirement before investment can be considered.

B.

Using ESG as a factor that informs the valuation.

C.

Using ESG as a risk assessment that offers a level of confidence in the valuation.

D.

Using ESG as a basis for explaining investment holdings to clients.

解释:

本题考查基金经理整合ESG的方式:

- as a threshold requirement before investment can be considered;

- as a factor that informs the valuation or provides a quant basis for adjusting (or tilting) exposures;

- as a risk assessment that offers a level of confidence in the valuation;

- as a basis for stewardship engagement; or

- as a combination of two or more of these methods, which is very often the case.

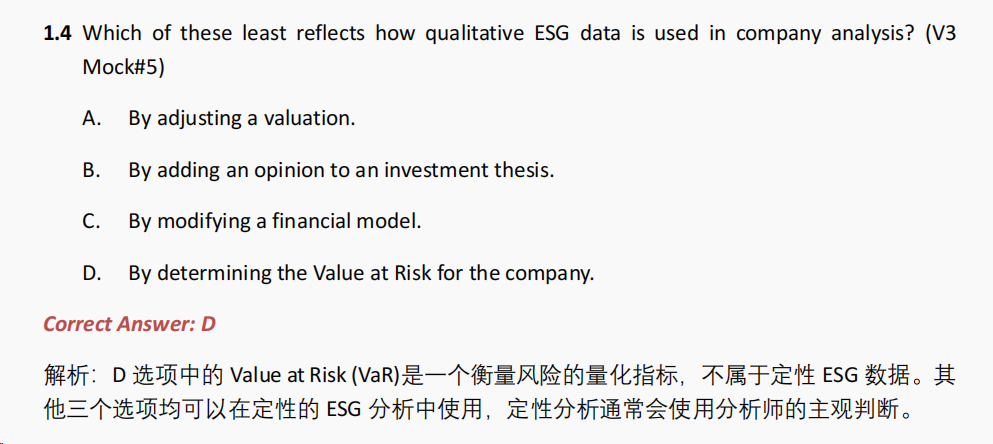

C. Using ESG as a risk assessment that offers a level of confidence in the valuation. 这个我理解的意思是:ESG在风险评估时能提供的估值置信水平?esg能在置信水平中考虑吗?怎么考虑呢?我记得还有个题目就是选的 esg不能在VaR中使用