NO.PZ201809170400000201

问题如下:

Which of Tong’s statements regarding equity index benchmarks is (are) correct?

选项:

A.

Only Statement 1

B.

Only Statement 2

C.

Both Statement 1 and Statement 2

解释:

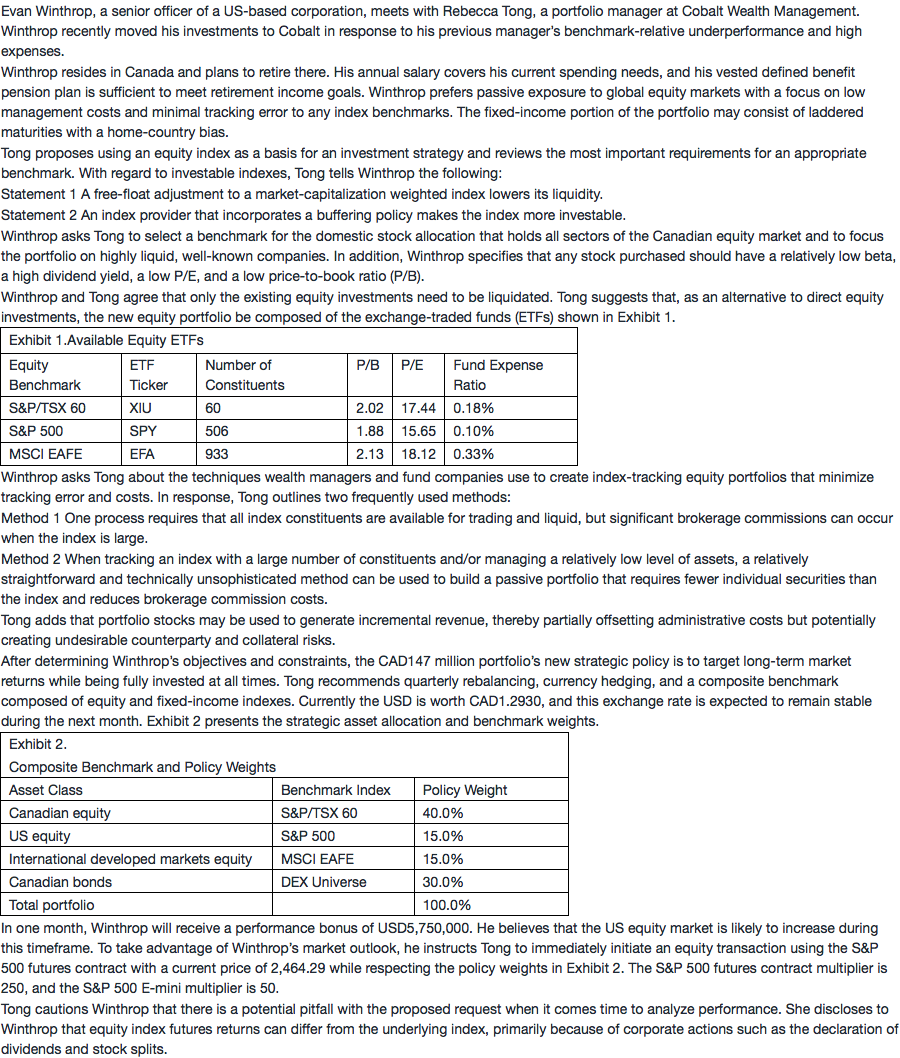

B is correct. The three requirements for an index to become the basis for an equity investment strategy are that the index be (a) rules based, (b) transparent, and (c) investable. Buffering makes index benchmarks more investable (Statement 2) by making index transitions a more gradual and orderly process.

A is incorrect because basing the index weight of an individual security solely on the total number of shares outstanding without using a free-float adjustment may make the index less investable. If a stock market cap excludes shares held by founders, governments, or other companies, then the remaining shares more accurately reflect the stock’s true liquidity. Thus a free-float adjustment (Statement 1) to a market index more accurately reflects its actual liquidity (it does not lower its liquidity). Many indexes require that individual stocks have float and average shares traded above a certain percentage of shares outstanding.

排除法做对的,知道buffering有降低调构成的成本的作用,但如何理解buffering使得组合more investable?