NO.PZ202309050300000103

问题如下:

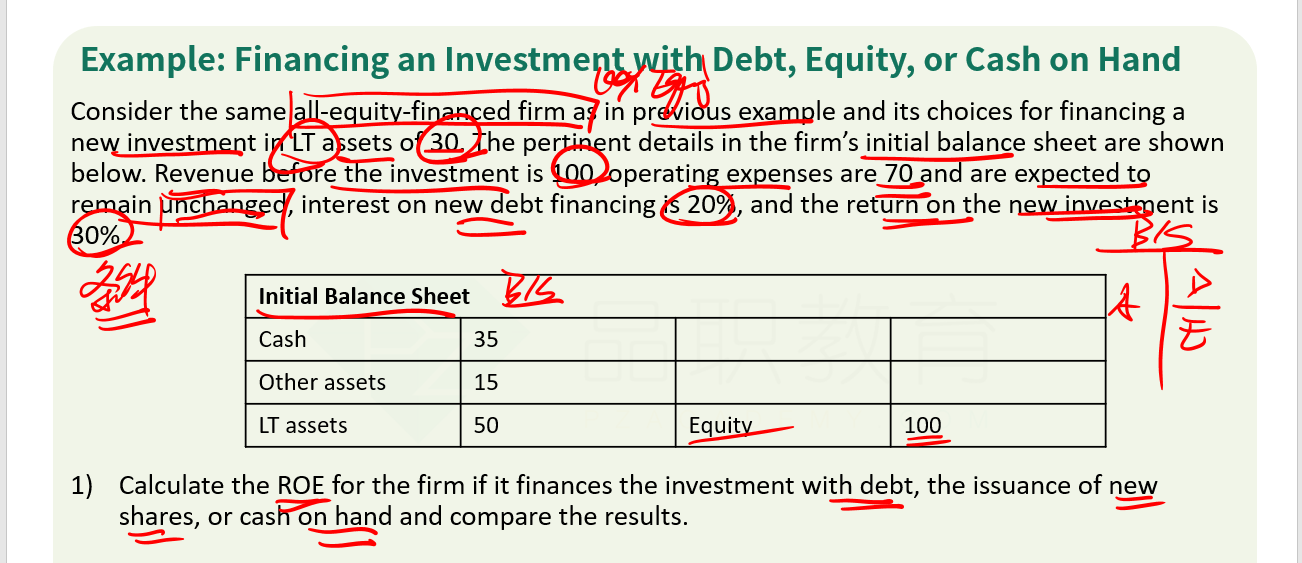

Consider the same all-equity-financed firm as in Question 1 and its choices for financing a new investment in LT assets of 40. The pertinent details in the firm’s initial balance sheet are shown below.

Revenue before the investment is 200, operating expenses are 140 and are expected to remain unchanged, interest on new debt financing is 20%, and the return on the new investment is 30%.

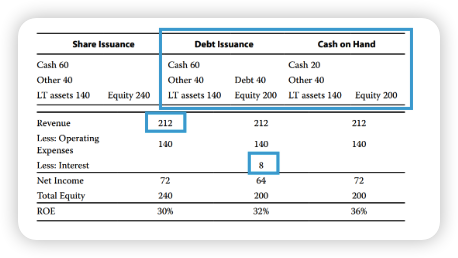

Calculate the ROE for the firm if it finances the investment with debt, the issuance of new shares, or cash on hand and compare the results.

Discuss the results of the comparison.

选项:

解释:

Financing the investment with new shares produces the lowest ROE among the three financing options. However, since the investment produced a return equal to the beginning ROE, there was no change in ROE from the initial case.

Financing with debt produced a higher ROE, because the interest rate on debt was lower than the return on the new investment and no new shares were issued, avoiding dilution.

The highest ROE was produced by using excess cash on hand, which avoids both dilution and the interest cost of debt.

蓝色框里的数字,都是如何甲酸得来的呢?