NO.PZ202212280100005201

问题如下:

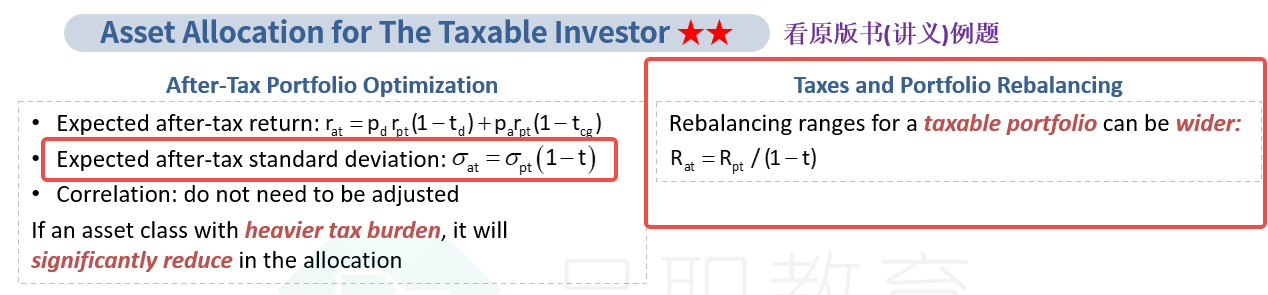

(1) The broker

suggests that Young rebalance her $5.5 million money market account and the

$3.0 million tax-deferred retirement account periodically in order to maintain

their targeted allocations. The broker proposes the same risk profile for the

equity positions with two potential target equity allocations and rebalancing

ranges for the two accounts as follows:

·

Alternative 1: 80% equities +/–

8.0% rebalancing range

·

Alternative 2: 75% equities +/–

10.7% rebalancing range

Determine

which alternative best

fits each account.

解释:

如题,答案中关于5.5million的这个账户可以再详细解释一下吗?谢谢