NO.PZ2023101601000044

问题如下:

A credit manager in the counterparty risk division of

a large bank uses a simplified version of the Merton model to monitor the

relative vulnerability of its largest counterparties to changes in their

valuation and financial conditions. In order to assess the risk of default of

three particular counterparties, the manager calculates the distance to default

assuming a 1-year horizon (t=1). The counterparties: Company P, Company Q, and

Company R, belong to the same industry. Selected information on the companies

is provided in the table below:

Using the information above with the assumption

that short-term debt is the only liability for each company, and the

approximation formula of the distance to default, what is the correct ranking

of the counterparties, from most likely to least likely to default?

选项:

A.

P; R; Q

B.

Q; P; R

C.

Q; R; P

D.

R; Q; P

解释:

A is

correct.

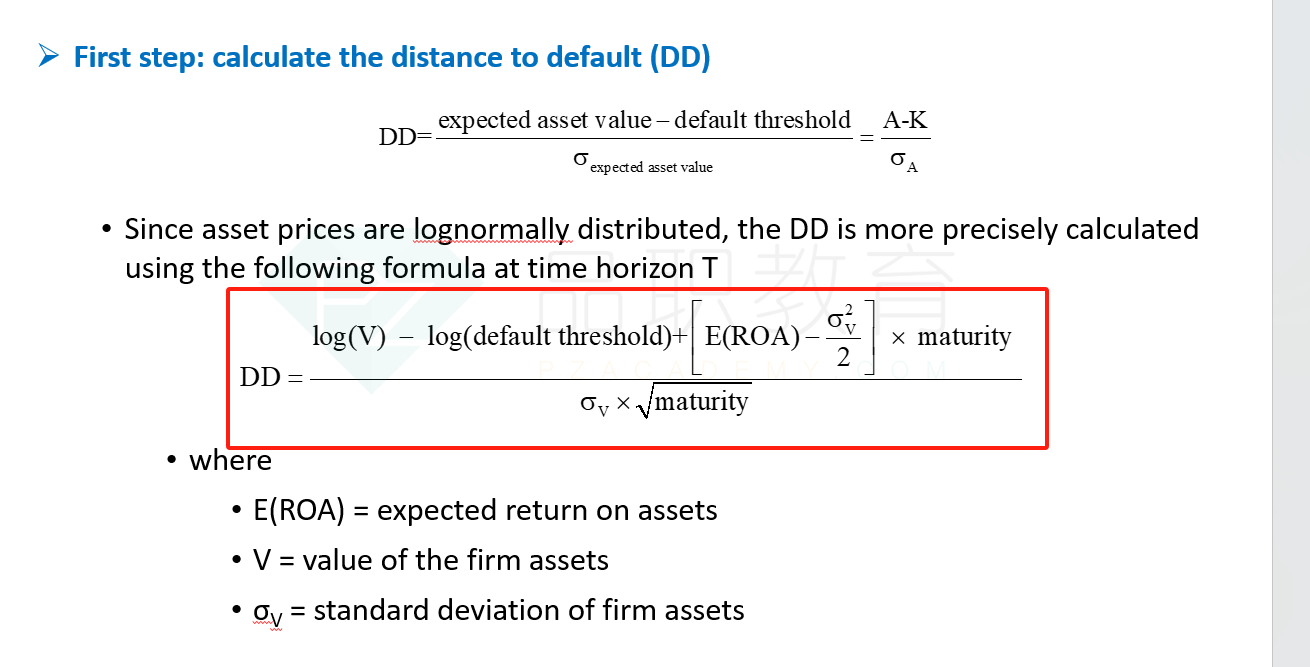

Distance

to Default (DtD) approximates the number of standard deviations to reach the

default threshold; thus, the higher the DTD, the least likely to default.

DtD can

be simplified by reducing the forward time periods to 1 (t=1) and minimizing

the drift factors (µ -σ2/2) that tend to be small (assumed to equal 0) over one period to

yield:

[ln(market

value of assets/face value of debt)/annual volatility of asset value)].

Using

this formula results in: Company P = ln(100/60)/0.10 = 5.11

Company Q

= ln(150/100)/0.07 = 5.79

Company R

= ln(250/160)/0.08 = 5.58

Q is

least likely to default; R is in the middle; P is most likely to default.

老师您好,请问这是哪个知识点里面的内容呀?可以解释一下这道题嘛?谢谢老师