- Comment 1: The price of a forward contract is the future value of the underlying adjusted upward for carry costs, and downward for carry benefits.

- Comment 2: The price of a forward contract is positive at contract inception, but can be positive or negative during the term of the contract and at expiration.

- Comment 3: In a receive-floating and pay-fixed interest rate swap, pricing involves finding the fixed swap rate such that the value of the swap at initiation is zero.

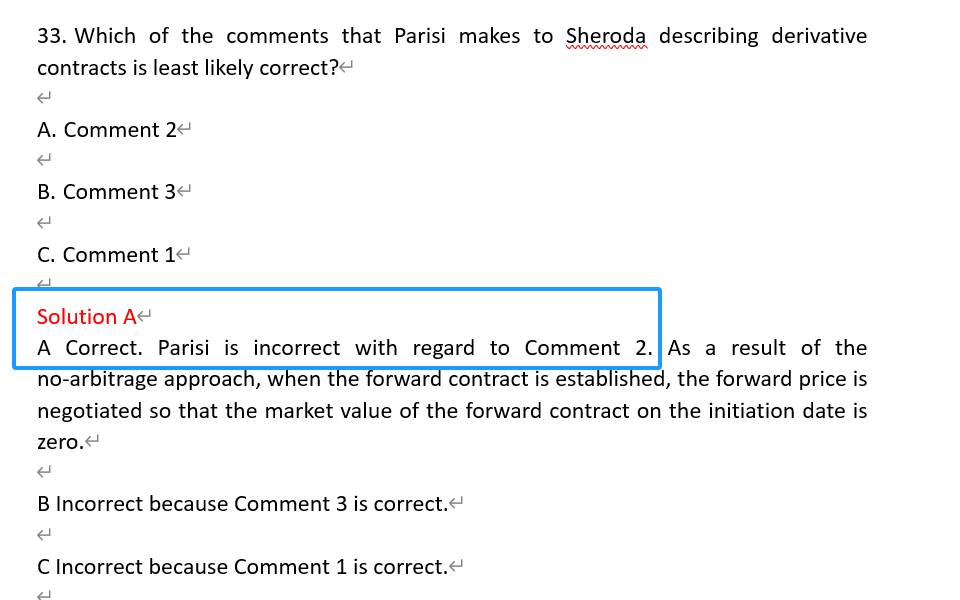

Which of the comments that Parisi makes to Sheroda describing derivative contracts is least likely correct?

A Comment 2

B Comment 3

C Comment 1

B is correct

想借这个问题问一下,远期合约的价格或者说期货的价格在合约开始时是否一定为正值?

(比如原油宝事件中期货价格跌至负值)

但如果是负值,基于无套利原则,大概是由于现货-收益+成本是负值了?