NO.PZ2018062002000053

问题如下:

Which of the following reason is a most accurately way to explain the price return of an equal-weighted index surpass the return of market-capitalization-weighted index which contains the same stocks?

选项:

A.

stock splits.

B.

dividend distributions.

C.

outperformance of small-market-capitalization stocks.

解释:

C is correct.

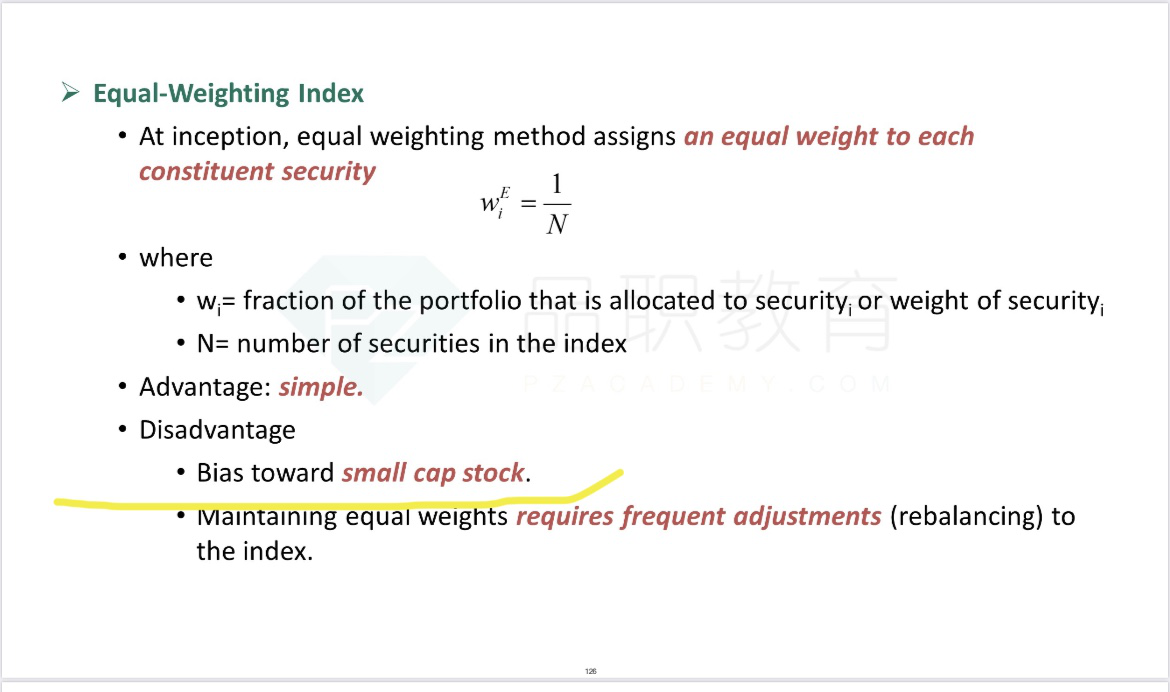

The return difference was mainly due to the outperformance of small cap stocks and underperformance of large cap stocks.As we all knew from the class,equal-weighted index bias towards the small cap stock. Therefore, when small cap stocks outperform large cap stocks, the equal-weighted index will have a relatively higher yield.

考点:指数构建方法优缺点之间的对比

题目问什么原因会导致等权重方法构建的指数收益率超过市值加权方法构建的指数。等权重指数因为受到小盘股影响比较大,如果小盘股表现很好的话,那么等权重指数的收益率就会更大。但是对于市值加权的指数,市值大的股票权重大,因此说明小盘股在市值加权指数占比也小,那么小盘股表现好对于指数收益的影响也就很小。

题目不太理解 可以翻译一下吗