NO.PZ2023091802000035

问题如下:

A construction company that was hired for a multiyear expects to purchase 1,000.000 gallons of diesel fuel on the market over the next year to run its machinery .To hedge possible changes in the spot price of diesel fuel, the construction company buys diesel futures. Which of the following statements regarding basis risk in this situation is correct?

选项:

A.

Basis risk will arise if there is a mismatch between the maturity dates of the futures contracts and the dates that spot purchases will have to be made.

B.

Basis risk will arise if the construction company’s actual need for diesel fuel exceeds the expected need when the futures were purchased.

C.

Basis risk will not arise from a mismatch between the delivery location specified in the futures contract and the location the diesel fuel is needed if the spot purchases are made over-the-counter for delivery to the exact project location.

D.

Basis risk will not arise from a mismatch between the grade of diesel specified in the futures contract and the grade required to run the machinery unless delivery occurs.

解释:

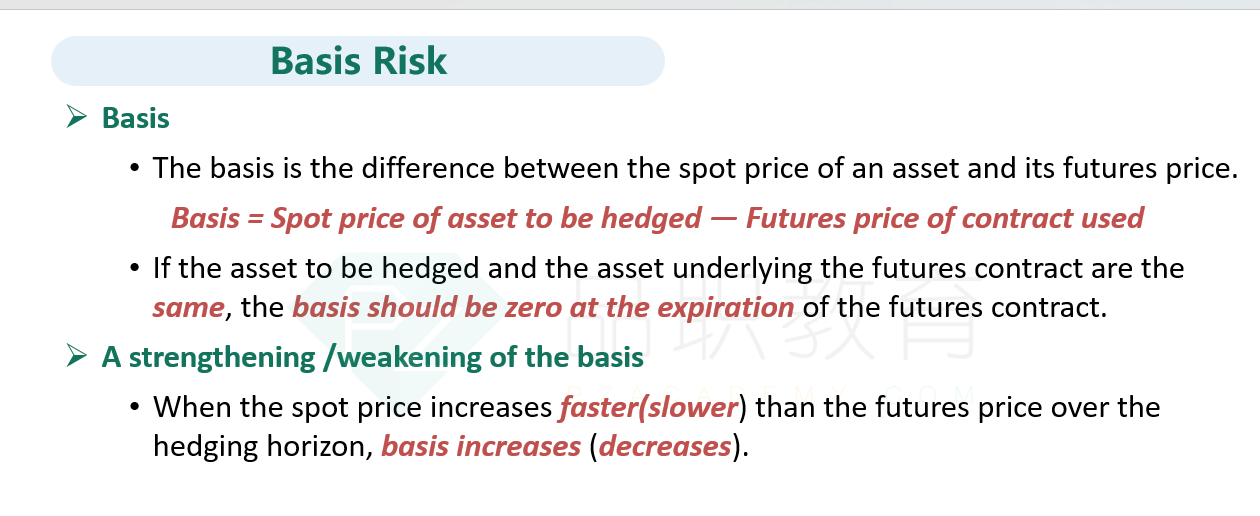

基差风险主要有哪些能否简单列举