Stark asks Parker to evaluate whether the common stock of Company D is undervalued, fairly valued, or overvalued based on a residual income model. Parker uses the two-stage residual income model to value Company D’s share. For her analysis, she assumes the following:

- Current market price is $24.00.

- Beginning book value per share is $20.00.

- Earnings per share will be 32% of beginning book value for the next year.

- Cash dividends will be 50% of earnings per share for the next year.

- At the end of the year, the stock's P/B ratio will be 1.1.

- Required rate of return on equity is 10%.

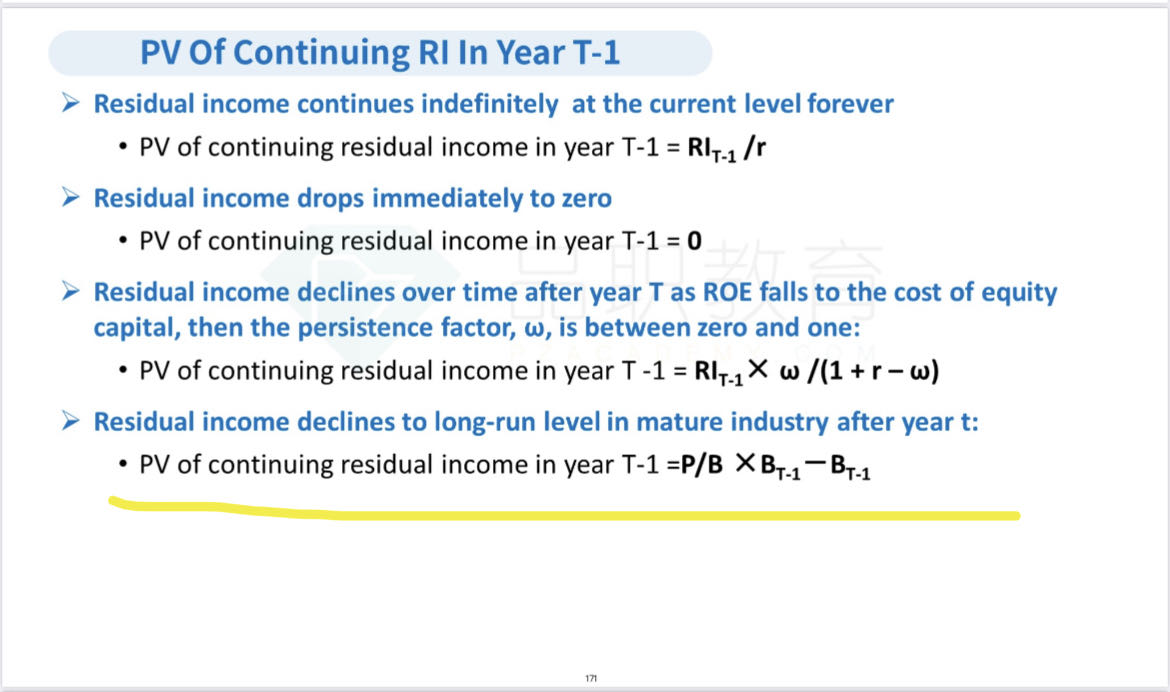

以下是答案里计算value的过程:

为什么这里面的terminal value 用的乘数是0.1而不是题目中给的1.1?