NO.PZ202304060100015002

问题如下:

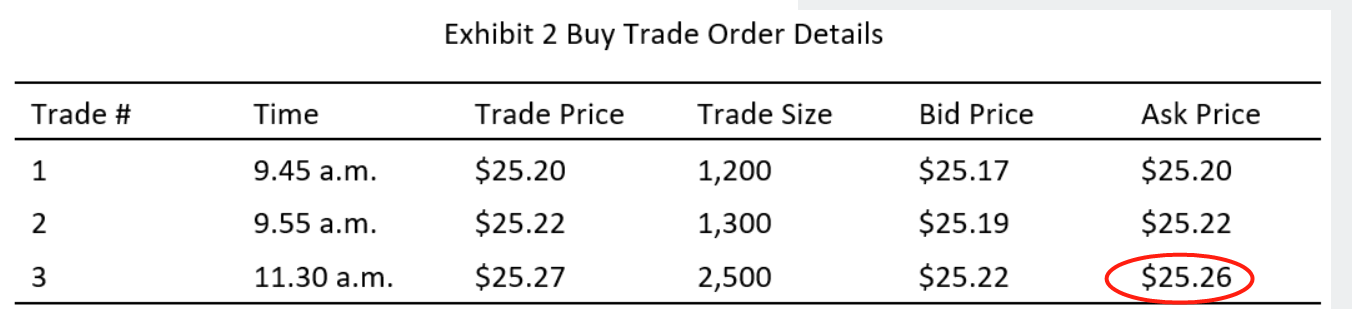

Based on Exhibit 2, the average effective spread of the three trades is closest to:

选项:

A.$0.0333.

$0.0367.

$0.0400.

解释:

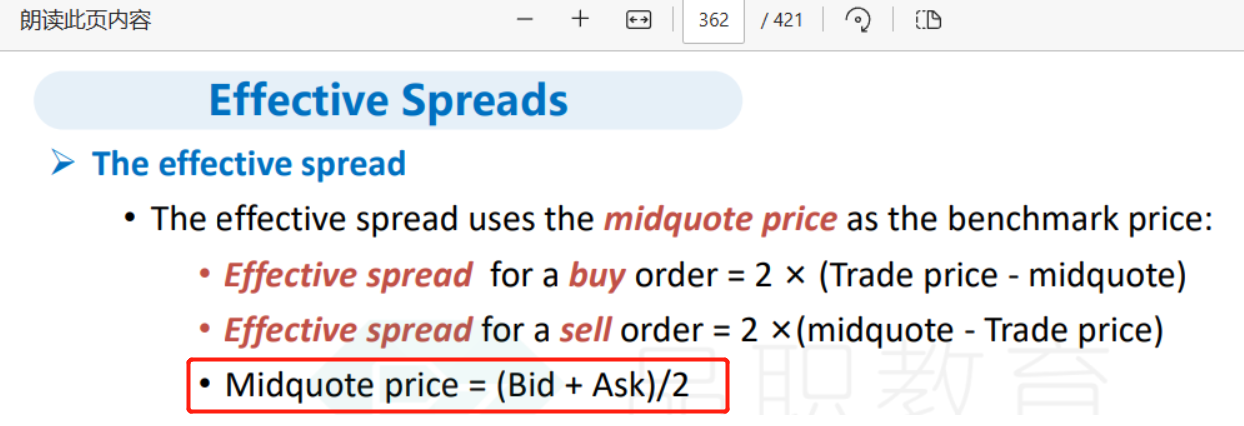

C is correct. The effective bid–ask spread for buy orders is calculated as: Effective bid–ask spread (buy order) = 2 × {Trade price – [(Ask price + Bid price) / 2)]}

- Effective spread of Trade 1 = 2 × {$25.20 – [($25.20 + $25.17)/2]} = $0.0300.

- Effective spread of Trade 2 = 2 × {$25.22 – [($25.22 + 25.19)/2]} = $0.0300.

- Effective spread of Trade 3 = 2 × {$25.27 – [($25.26 + $25.22)/2]} = $0.0600.

- Average effective spread = (Effective spread of Trade 1 + Effective spread of Trade 2 + Effective spread of Trade 3)/3.

- Average effective spread = ($0.0300 + $0.0300 + $0.0600)/3 = $0.0400.

为什么第三笔交易的midqute,是用(25,26+25.22)/2,25.26是从哪里得来的