NO.PZ2022101402000005

问题如下:

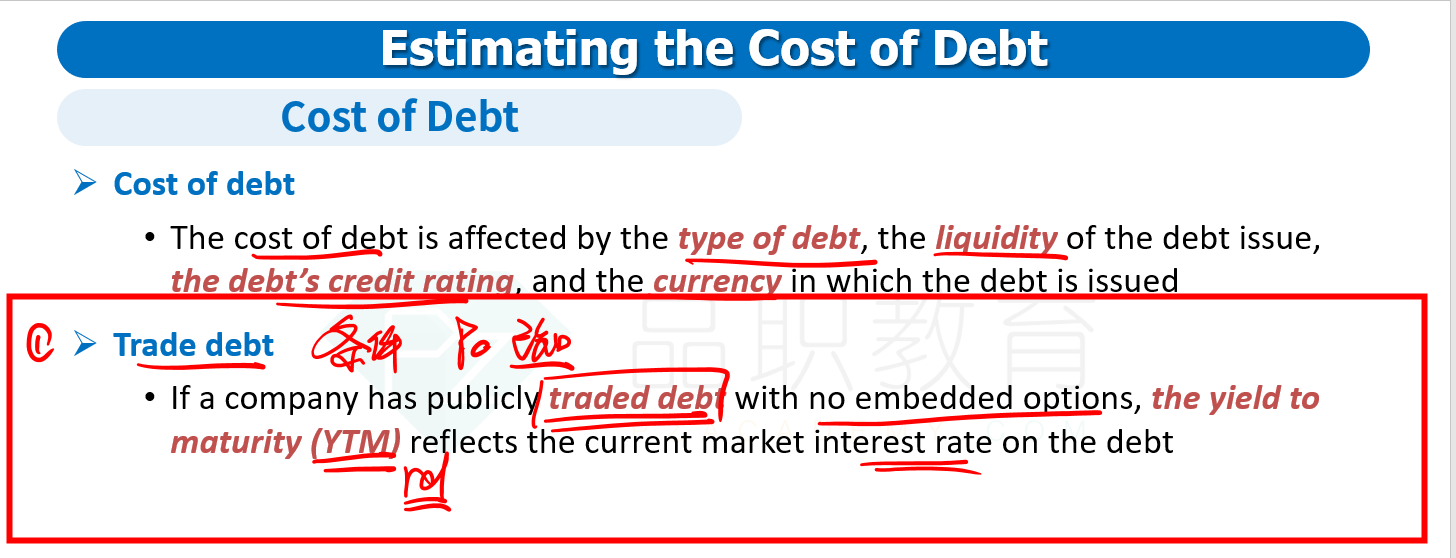

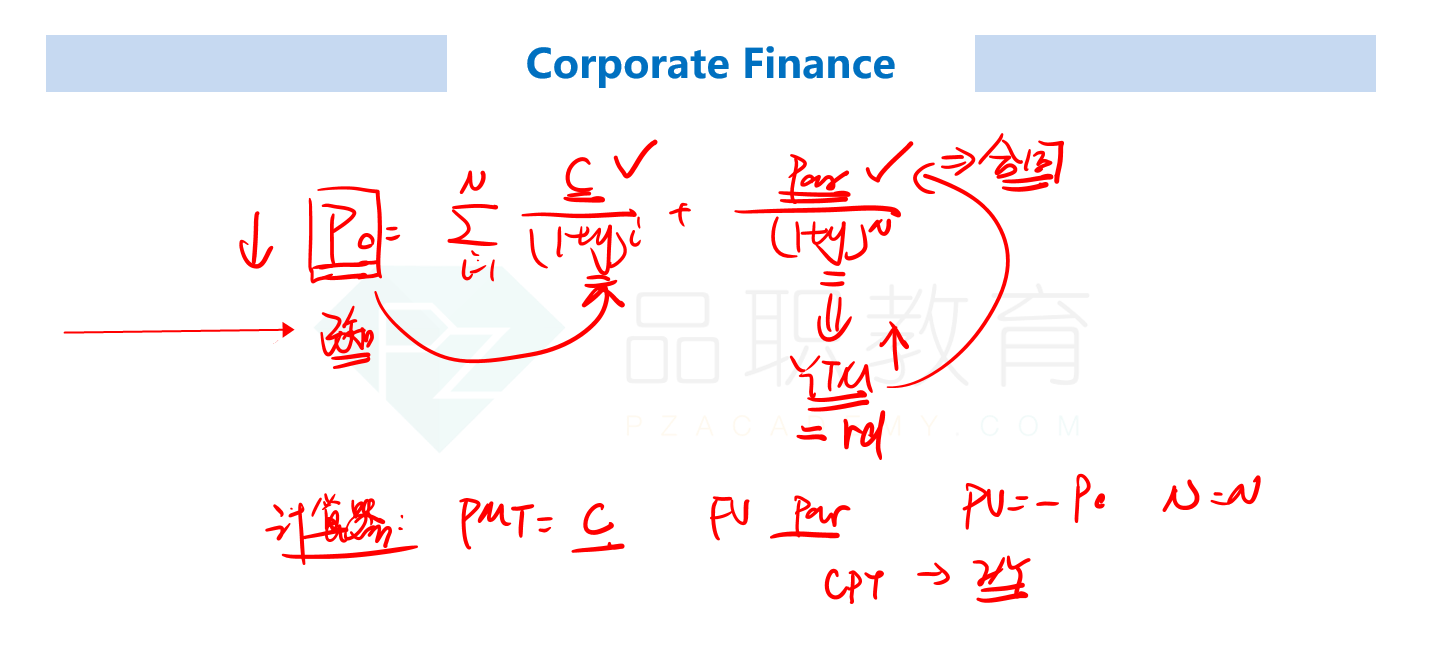

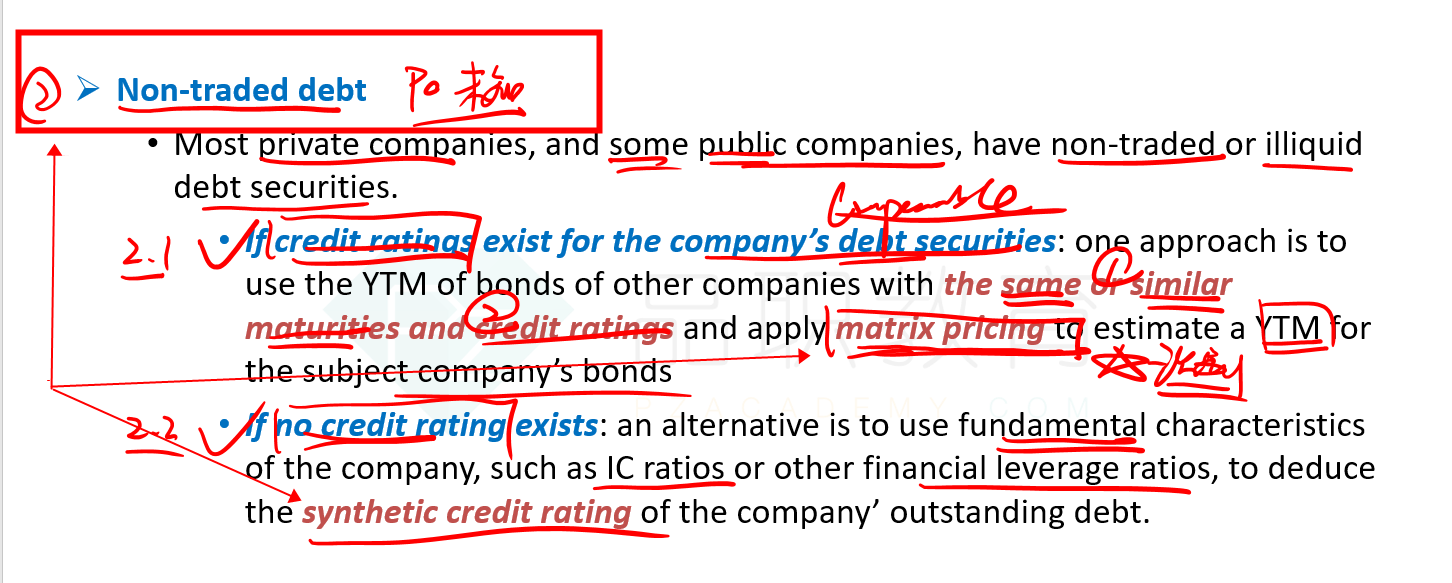

An analyst is estimating the cost of debt for a company with outstanding debt that is not traded. Which methods is least likely be considered for estimating the company’s cost of debt?

选项:

A.Matrix pricing

Synthetic rating

The yield to maturity (YTM)

解释:

C is correct.

A is incorrect. Matrix pricing – Identifying other debt that is publicly traded with similar features in maturity, features, and credit quality.

B is incorrect. Synthetic rating – Using the companies’ fundamentals, such as IC ratios and other leverage ratios, to estimate a credit rating class. Once a credit rating has been inferred, an analyst can simply use the YTM on bonds with a similar maturity and credit rating to estimate a cost of debt.

题目不是说这个debt不会交易,所以应该用YTM正好呀,为什么不可以用YTM呢?