NO.PZ2021090804000006

问题如下:

Johnson is a tax adviser who provides tax awareness advice to private clients. One of Johnson’s clients is Lily.

Lily asks Johnson to evaluate Mutual Fund A, which has an embedded gain of 10% of the ending portfolio value. Lily asks Johnsonto calculate a post-liquidation return over the most recent three-year period. Mutual Fund A exhibited after-tax returns of 9.0% in Year 1, 5% in Year 2, and 8% in Year 3, and capital gains are taxed at a 25% rate.

The annualized after-tax post-liquidation return calculated by Johnson is closest to:

选项:

A.21.1%

B.5.62%. C.6.41%

解释:

C is correct.

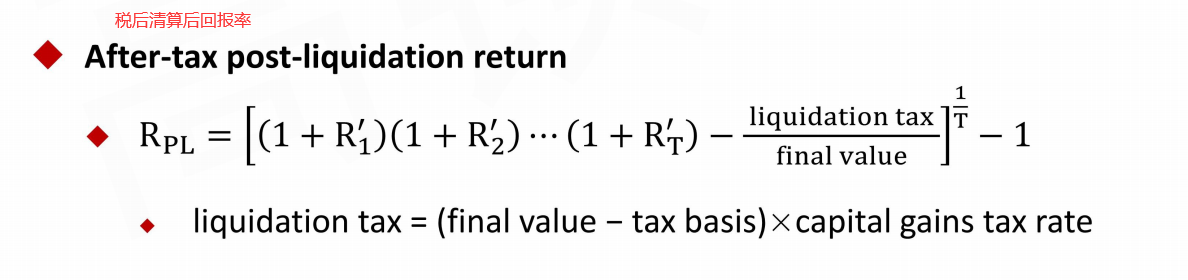

The annualized after-tax post-liquidation return is calculated as follows.

First, calculate the ending portfolio value. Given Fund A’s after-tax returns over the past three years, the ending portfolio value is calculated as

Final after-tax portfolio value = (1 + 0.09) × (1 + 0.05) × (1 + 0.08) = 1.236.

The after-tax returns compounded in this way account for the tax on distributions and realized capital gains but do not account for any unrealized capital gains. The assumed tax liability from capital gains at liquidation is 2.5% of the final value, which is the product of the 10% embedded gain and the 25% capital gains tax rate. The portfolio value net of the unrealized gains tax liability is given by subtracting the assumed tax liability from capital gains at liquidation from the final after-tax portfolio value:

Portfolio value net of the unrealized gains tax liability = 1.236 ×(1-0.025) = 1.205.

Second, calculate the annualized post-liquidation return as follows:

1.2051/3 − 1=6.41%

年化税后清算后回报计算如下。

首先,计算期末投资组合价值。鉴于基金 A 过去三年的税后回报,期末投资组合价值计算为

最终的税后投资组合价值 = (1 + 0.09) × (1 + 0.05) × (1 + 0.08) = 1.236。

以这种方式复利的税后回报计算了分配税和已实现的资本收益,但不考虑任何unrealized capital gains。清算时资本收益的假定纳税义务为最终价值的 2.5%,这是 10% 的内含收益和 25% 的资本收益税率的乘积。通过从最终税后投资组合价值中减去清算时的资本收益中的假定税负,得出 The portfolio value net of the unrealized gains tax liability:

1.236 ×(1-0.025) = 1.205。

其次,计算年化清算后回报如下:

1.2051/3 − 1=6.41%