NO.PZ2019070101000047

问题如下:

An asset manager wants to hedge the interest risk of a short position on the 10-year bond whose DV01 is 0.0619, and a 5-year T-bond with a DV01 of 0.0285 is avaliable to use. The manager has to:

选项:

A.

Buy $46.04 of the 5-year T bond.

B.

Sell $46.04 of the 5-year T bond.

C.

Buy $217.19 of the 5-year T bond.

D.

Sell $217.19 of the 5-year T bond.

解释:

C is correct

考点:DV01 hedge.

解析:

已知原本的头寸为short10y债券 DV01=0.0619,想要用5y DV01=0.0285的债券来对冲掉原本的头寸的风险,问manager应该怎么做?

目标是使得组合价格的变动=0,

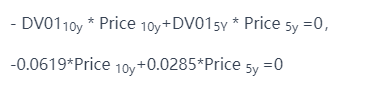

- DV0110y * Price 10y+DV015Y * Price 5y =0,

-0.0619*Price 10y+0.0285*Price 5y =0

Price 5y =0.0619*Price 10y/0.0285=2.1719Price 10y

代表想要对冲掉1$short position的10y债券的头寸,需要long 2.1719$的5y债券,答案选C

为什么要多乘100?