NO.PZ2023020602000167

问题如下:

An analyst gathered the following information about a company:

- Taxable income is $40,000.

- Pretax income is $50,000.

- Current tax rate is 50%.

- Tax rate when the reversal occurs will be 40%.

选项:

A.$3,500. B.$4,000.00 C.$5,000.00解释:

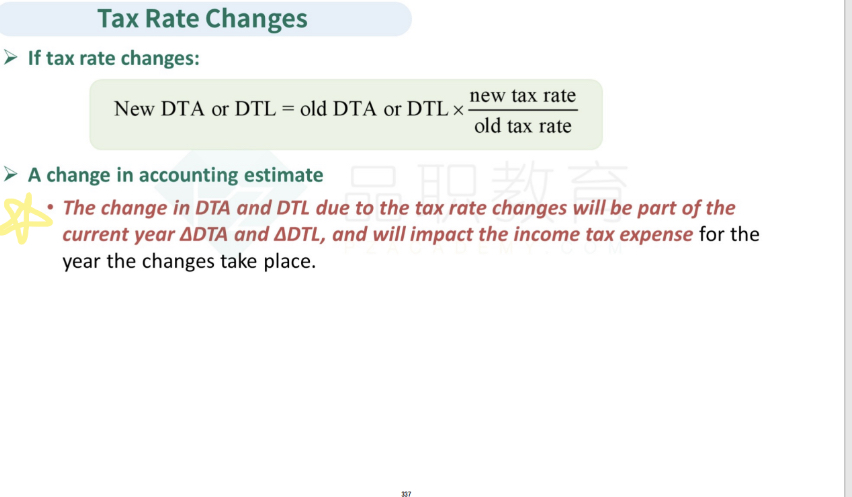

The tax rate that should be used is the expected tax rate when the liability reverses. The deferred tax liability will be $10,000 x 40% = $4,000.taxable income = 40k, pretax income = 50k,

左边asset上cash按照现有税率征税:cash: taxable income * current tax rate = -40k * 50% = -20k

右边liability上记DTL: ( pretax income - taxable income) * reversal_tax_rate = 10k * 40% = 4k

右边equity部分NI包含税:-pretax income * current tax rate = -50k * 50% = -25k

左右两边显然不平,那问题出在哪里呢?