NO.PZ2023040201000072

问题如下:

Hedge funds are similar to private equity funds in that both:选项:

A.are typically structured as partnerships. B.assess management fees based on assets under management. C.do not earn an incentive fee until the initial investment is repaid.解释:

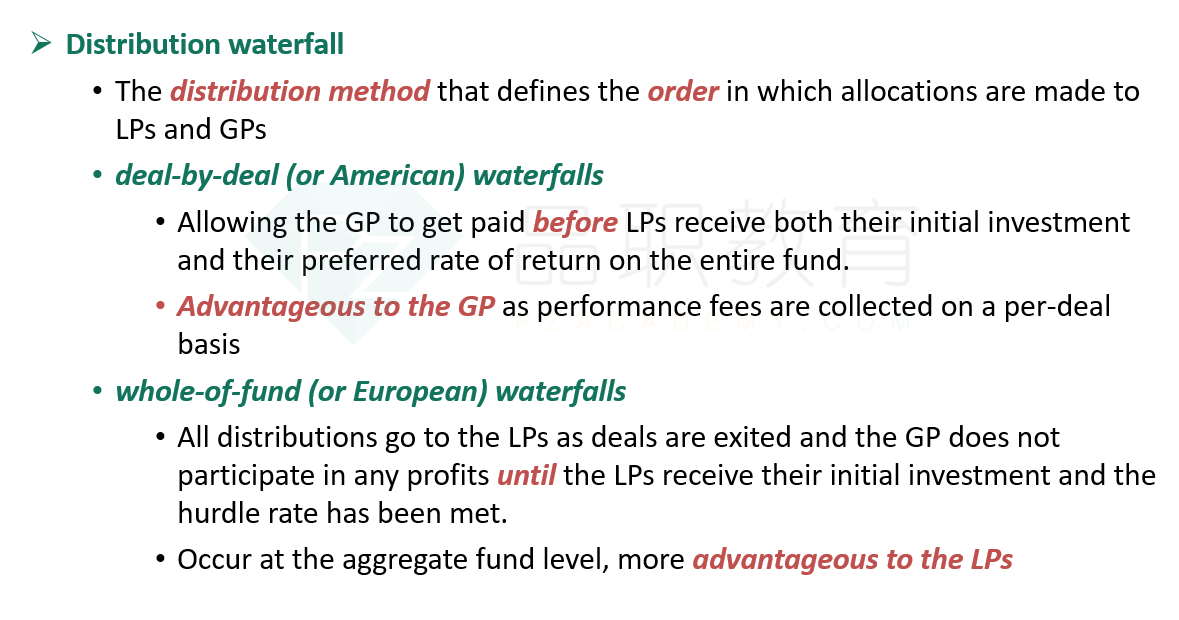

Private equity funds and hedge funds are typically structured as partnerships where investors are limited partners (LP) and the fund is the general partner (GP). The management fee for private equity funds is based on committed capital whereas for hedge funds the management fees are based on assets under management. For most private equity funds, the general partner does not earn an incentive fee until the limited partners have received their initial investment back.c选项错在哪里呢?还有a选项直接投资就不是partnership呀