NO.PZ2018122701000018

问题如下:

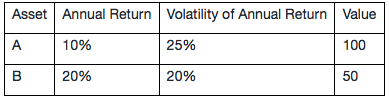

The bank’s trading book consists of the following two assets:

Correlation (A, B) = 0.2

How would the daily VaR at 99% level change if the bank sells $50 worth of asset A and buys $50 worth of asset B?

Assume there are 250 trading days in a year.

选项:

A.$0.2286

B.$0.4776

C.$0.7705

D.$0.7798

解释:

B is correct.

考点Parametric Estimation Approaches

解析The trade will decrease the VaR by 0.4776。

易错点:求daily VaR,但题干给的是annual return。

t=0,组合由$100A+$50B构成,μP =13.33%, 由年转化为天,13.33%/250=0.0533%.

σP =19.15%, 由年转化为天, 19.15%/SQRT(250)=1.2111%

daily 99%VaR=(2.33*1.2111%-0.0533%)*$150=$4.1528

t=1,组合由$50A+$100B构成,μP =16.66%, 由年转化为天,16.66%/250=0.0667%.

σP =17.08%, 由年转化为天, 17.08%/SQRT(250)=1.0801%

daily 99%VaR=(2.33*1.0801%-0.0667%)*$150=$3.6749

所以$4.1528-$3.6749=0.4779,最接近的是B选项。

如题,谢谢