NO.PZ2023031001000038

问题如下:

Two analysts are discussing the costs of external financing sources. The first states that the company's bonds have a known interest rate but that the interest rate on accounts payable and the interest rate on equity financing are not specified. They are implicitly zero. Upon hearing this, the second analyst advocates financing the firm with greater amounts of accounts payable and common shareholders equity. Is the second analyst correct in his analysis?

选项:

A.He is correct in his analysis of accounts payable only.

He is correct in his analysis of common equity financing only.

He is not correct in his analysis of either accounts payable or equity financing.

解释:

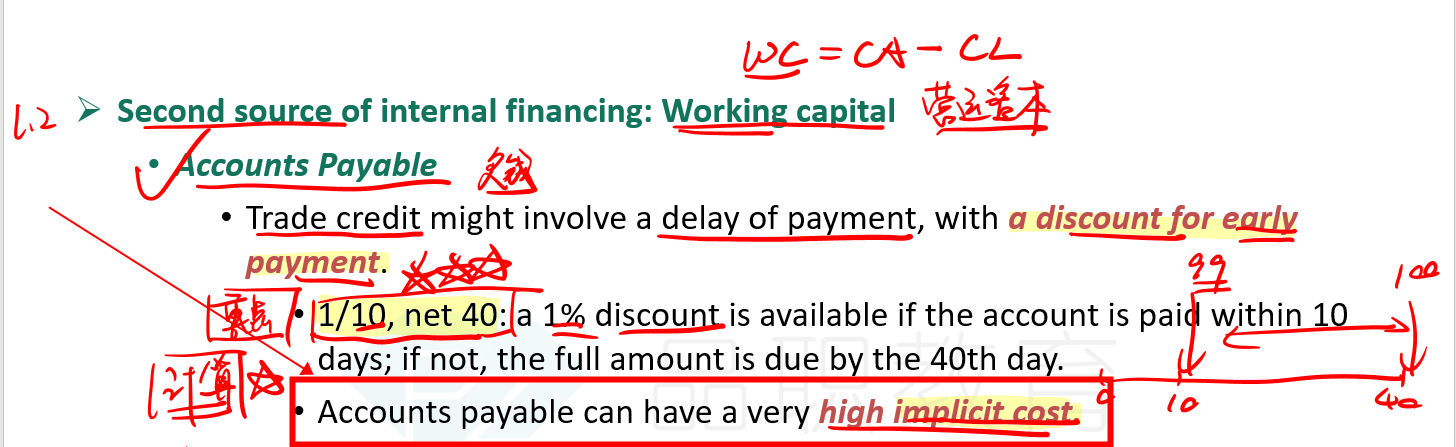

C is correct. Although accounts payable do not charge an explicit interest rate, the cost of accounts payable is reflected in the costs of the services or products purchased and in the costs of any discounts not taken. Accounts payable can have a very high implicit cost. Similarly, equity financing is not free. A required return is expected on shareholder financing just as on any other form of financing.

如题,谢谢