NO.PZ2023081403000050

问题如下:

Q. In 2018, a company using US GAAP made cash payments of USD6 million for salaries, USD2 million for interest expense, and USD4 million for income taxes. Additional information for the company is provided in the Exhibit 1:

Exhibit 1:

Cash Payments

Based only on the information in Exhibit 1, the company’s operating cash flow for 2018 is closest to:

选项:

A.USD6 million.

B.USD10 million.

C.USD14 million.

解释:

A is correct.

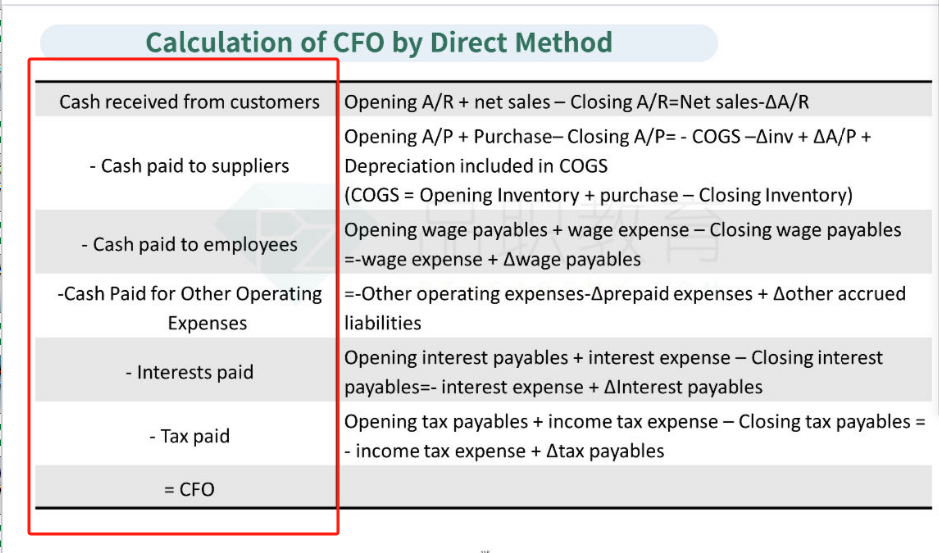

Operating cash flows = Cash received from customers – (Cash paid to suppliers + Cash paid to employees + Cash paid for other operating expenses + Cash paid for interest + Cash paid for income taxes)Cash received from customers = Revenue + Decrease in accounts receivable= USD37 + USD3 = USD40 millionCash paid to suppliers = Cost of goods sold + Increase in inventory + Decrease in accounts payable= USD16 + USD4 + USD2 = USD22 millionTherefore, the company’s operating cash flow = USD40 – USD22 – Cash paid for salaries – Cash paid for interest – Cash paid for taxes = USD40 – USD22 – USD6 – USD2 – USD4 = USD6 million.

算出来是—16–4+(—2)=—22,后面计算不用带负号吗?

不应该是40-(-22)-6-2-4吗