NO.PZ2022120703000055

问题如下:

Which of the following is most accurate regarding ESG issues in fixed income?

选项:

A.The ESG interests of long-term fixed income and equity investors do not often align B.For sovereign issuers, ESG engagement is a more common approach than applying an ESG tilt C.The probability of successful engagement is higher for private debt investors than for public debt investors解释:

C is correct because "the greatest opportunity to push for conditions and disclosures around ESG is likely to be pre-issuance. This can be difficult to implement in fast-moving public markets, but is easier to effect in private debt issuance."

A is incorrect because "in almost all cases relating to ESG matters at companies that are going concerns, the interests of long-term investors (whether they are exposed to equity or debt) very much align".

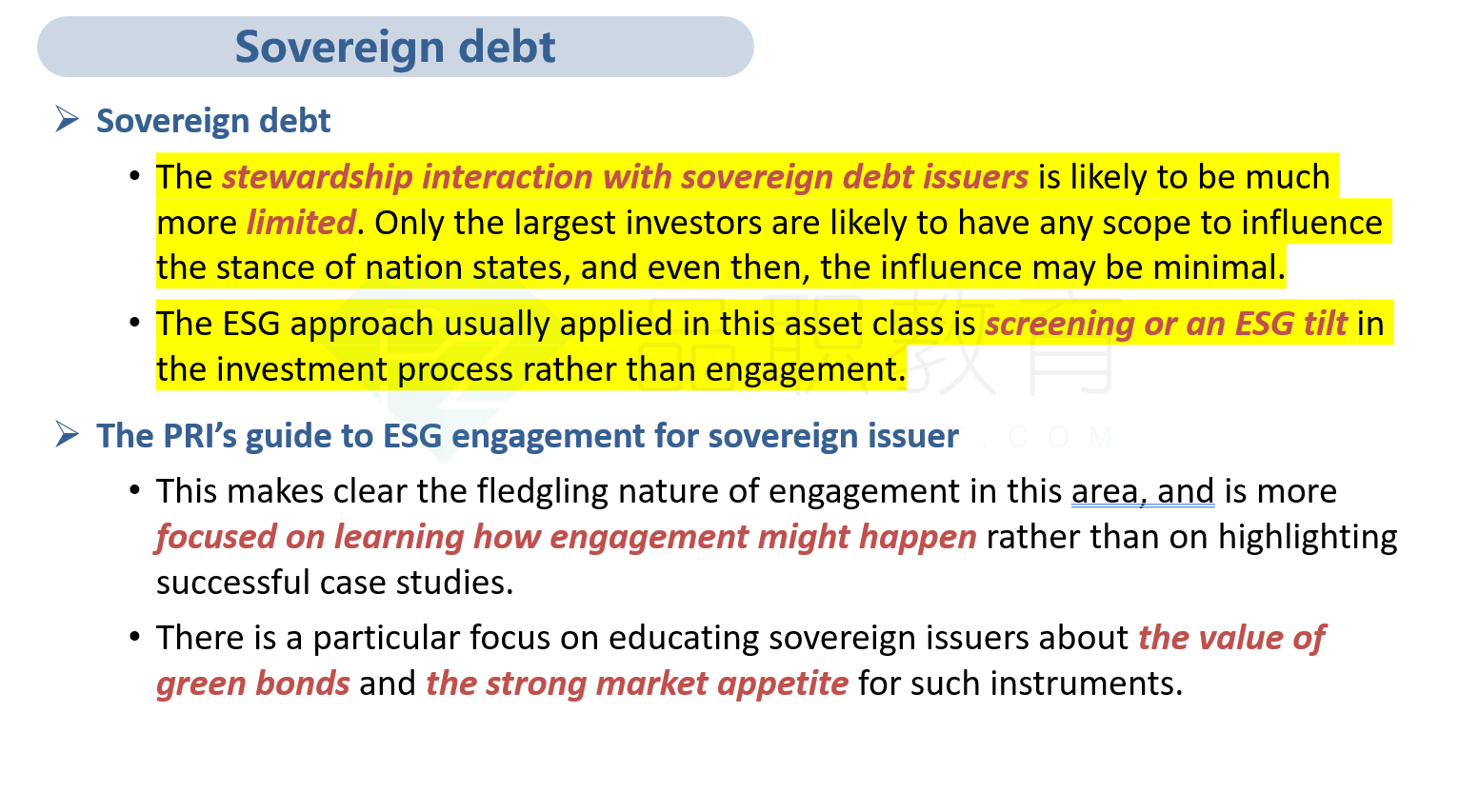

B is incorrect because "the ESG approach usually applied in this asset class sovereign debt is screening or an ESG tilt in the investment process rather than engagement."

以下是关于固定收益中ESG问题的准确性方面的解释:

A

长期固定收益和股权投资者的ESG利益通常不会保持一致

B

对于主权发行者,ESG参与比采用ESG倾向更常见

C

私人债务投资者相对于公共债务投资者而言,成功参与的可能性更高

正确答案是:B

解释:

B选项是最准确的。对于主权发行者(即政府或国家),通常更常见的是进行ESG参与,而不是采取ESG倾向。这意味着投资者更倾向于与主权债务发行者进行对话、合作和推动可持续性实践,而不是仅仅选择那些符合其ESG标准的债券。

A选项表示长期固定收益和股权投资者的ESG利益通常不一致,这不一定是正确的,因为有时候这些投资者的ESG利益可以保持一致。

C选项声称私人债务投资者相对于公共债务投资者更容易成功地进行ESG参与,这也不一定准确,因为成功的ESG参与取决于多个因素,包括投资者的能力和目标,而不仅仅是债务类型。