NO.PZ2022081802000062

问题如下:

Question Following its decision to divest its non-core assets, analysts expect HCL Corp’s standard deviation of returns to rise to 30% and its correlation with the market portfolio to remain unchanged at 0.8. The risk-free rate and the market risk premium are expected to remain unchanged at 6% and 8%, respectively. The market portfolio’s standard deviation of returns, however, is expected to decrease to 15%. The firm’s expected return after the restructure is closest to:

选项:

A.9.2%.

B.17.6%.

C.18.8%.

解释:

SolutionC is correct. We first compute the firm’s beta using

βi=ρi,mσiσm

The beta is

βi=0.8(0.30)0.15=1.6

The expected return is computed using

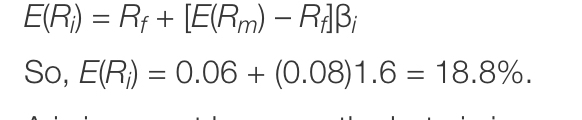

E(Ri) = Rf + [E(Rm) – Rf]βi

So, E(Ri) = 0.06 + (0.08)1.6 = 18.8%.

A is incorrect because the beta is incorrectly calculated as [(0.8 × 0.15)/0.30] = 0.4, resulting in an expected return of 0.06 + (0.08)0.4 = 9.2%.

B is incorrect because the expected return is incorrectly calculated as 0.08 + (0.06)1.6 = 17.6%.

E(Rm) - Rf不是应该0.02吗?为什么直接用了E(Rm)0.08?