NO.PZ201712110200000401

问题如下:

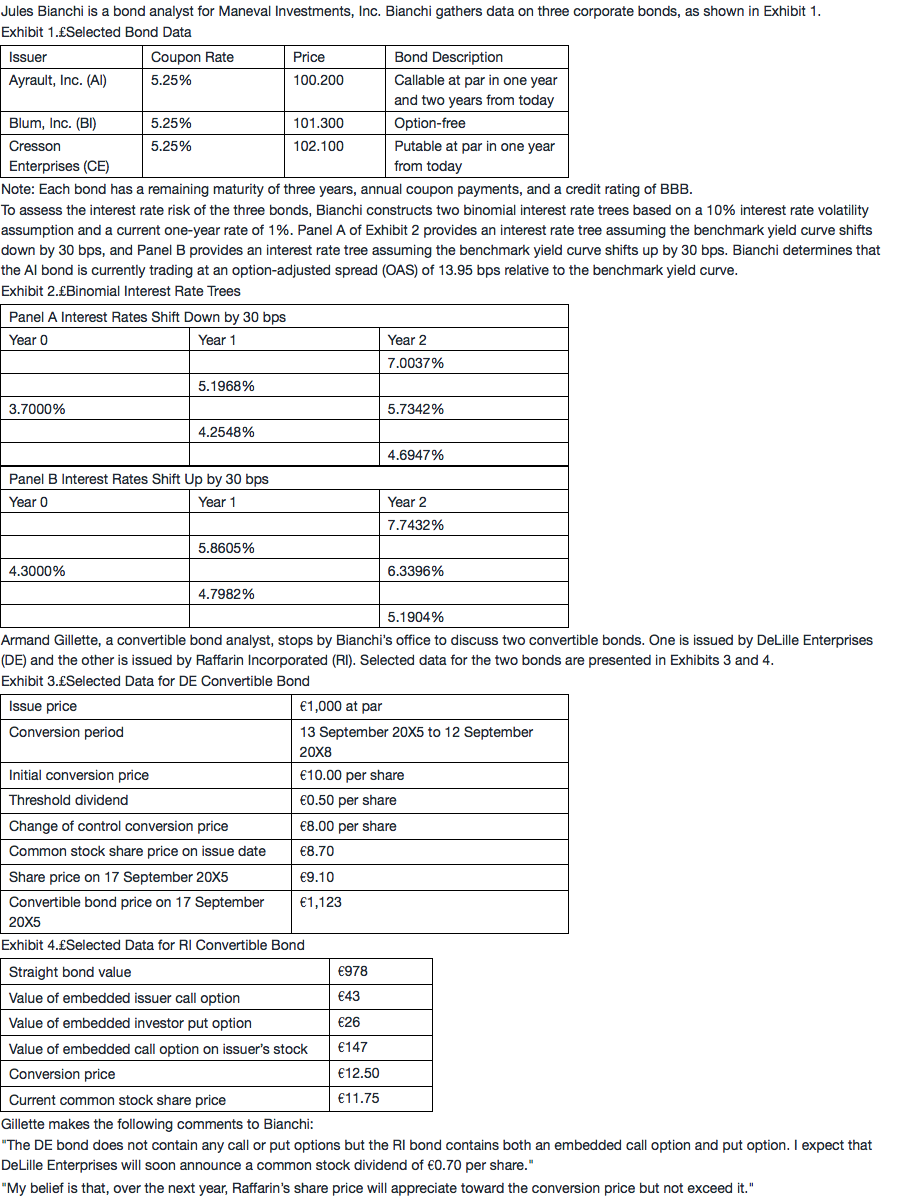

Based on Exhibits 1 and 2, the effective duration for the AI bond is closest to:

选项:

A.

1.98.

B.

2.15.

C.

2.73.

解释:

B is correct.

The AI bond’s value if interest rates shift down by 30 bps (PV–) is 100.78. The AI bond’s value if interest rates shift up by 30 bps (PV+) is 99.487.

Effective duration=[(PV-)-(PV+)]/[2× (ΔCurve) × (PV0)]= (100.780 - 99.487)/ (2 × 0.003 × 100.200)=2.15

对于含权债券如何判断题目给的现金流是否含权,什么时候需要在分母加oas