NO.PZ202208100100000104

问题如下:

In her statement to Patel, Cho is most likely correct regarding the:

选项:

A.

volatility skew.

B.

volatility smile.

C.

risk-reversal strategy.

解释:

A is correct. Cho correctly describes the volatility skew. Implied volatility for out-of-the-money (OTM) put options is higher than for at-the-money (ATM) put options and increases as the strike price moves further away from the current stock price. Implied volatilities for OTM call options are lower than for ATM call options and decrease as strike prices rise above the current stock price.

B is incorrect. Cho is incorrect about the volatility smile. The volatility smile occurs when OTM call and put option volatilities are higher than ATM option volatilities and are also higher than normal volatilities for OTM put and call options.

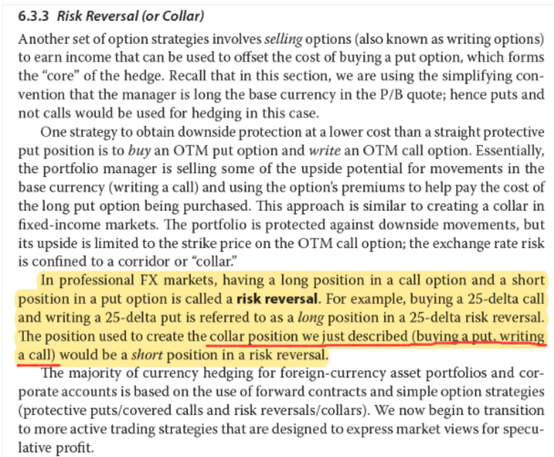

C is incorrect. Cho is incorrect about the long risk-reversal strategy; in fact, she describes a short risk-reversal strategy. If the put-implied volatility is too high relative to call-implied volatility, you would devise a long risk-reversal strategy by shorting the out-of-the-money put option and go long the out-of-the-money call option.

A和C选项纠结中,选择了C