NO.PZ2023091701000094

问题如下:

Bank A and Bank B are two competing investment banks that are calculating the 1-day 99% VaR for an at-the-money call on a non-dividend-paying stock with the following information:

Current stock price: USD 120

Estimated annual stock return volatility: 18%

Current Black-Scholes-Merton option value: USD 5.20

Option delta: 0.6

To compute VaR, Bank A uses the linear approximation method, while Bank B uses a Monte Carlo simulation method for full revaluation. Which bank will estimate a higher value for the 1-day 99% VaR?

选项:

A.Bank A. B.Bank B. C.Both will have the same VaR estimate. D.Insufficient information to determine.解释:

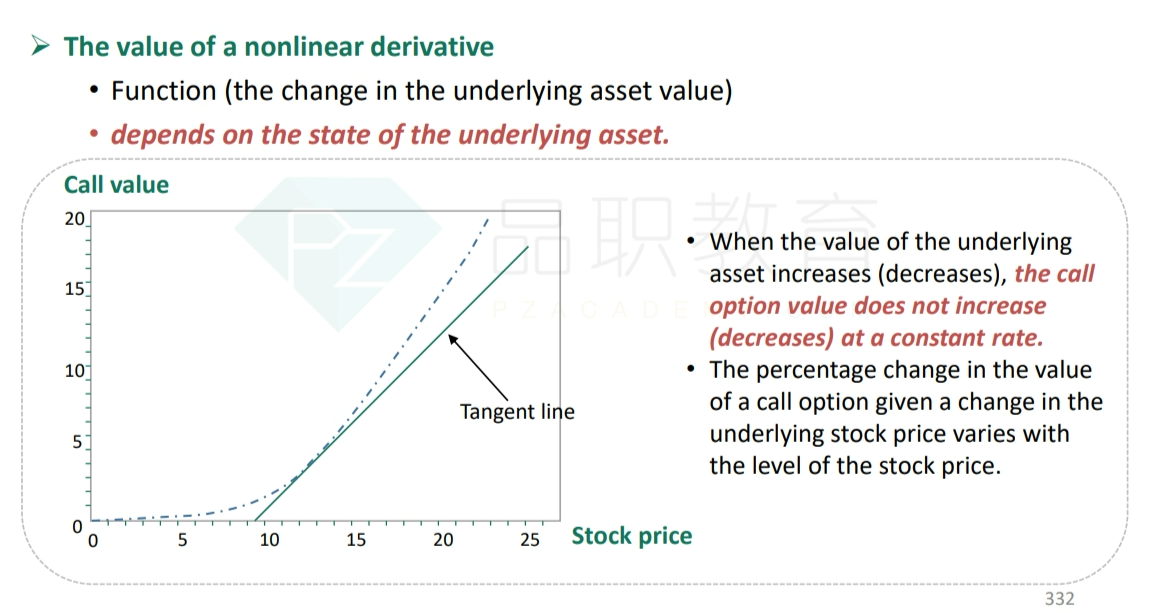

The option’s return function is convex with respect to the value of the underlying; therefore the linear approximation method will always underestimate the true value of the option for any potential change in price. Therefore the VaR will always be higher under the linear approximation method than a full revaluation conducted by Monte Carlo simulation analysis. The difference is the bias resulting from the linear approximation, and this bias increases in size with the change in the option price and with the holding period.

好像没有提到Monte Carlo模拟与linear 的比较。我的理解是Monte Carlo模拟涉及到Convex情况,预测的Var应该大于linear才对