NO.PZ202304050100001101

问题如下:

(1) If Eagle uses the equity method, the income ($ millions) from its investment in Aurora for 2012 will be closest to:

选项:

A.16.2.

17.4.

21.0.

解释:

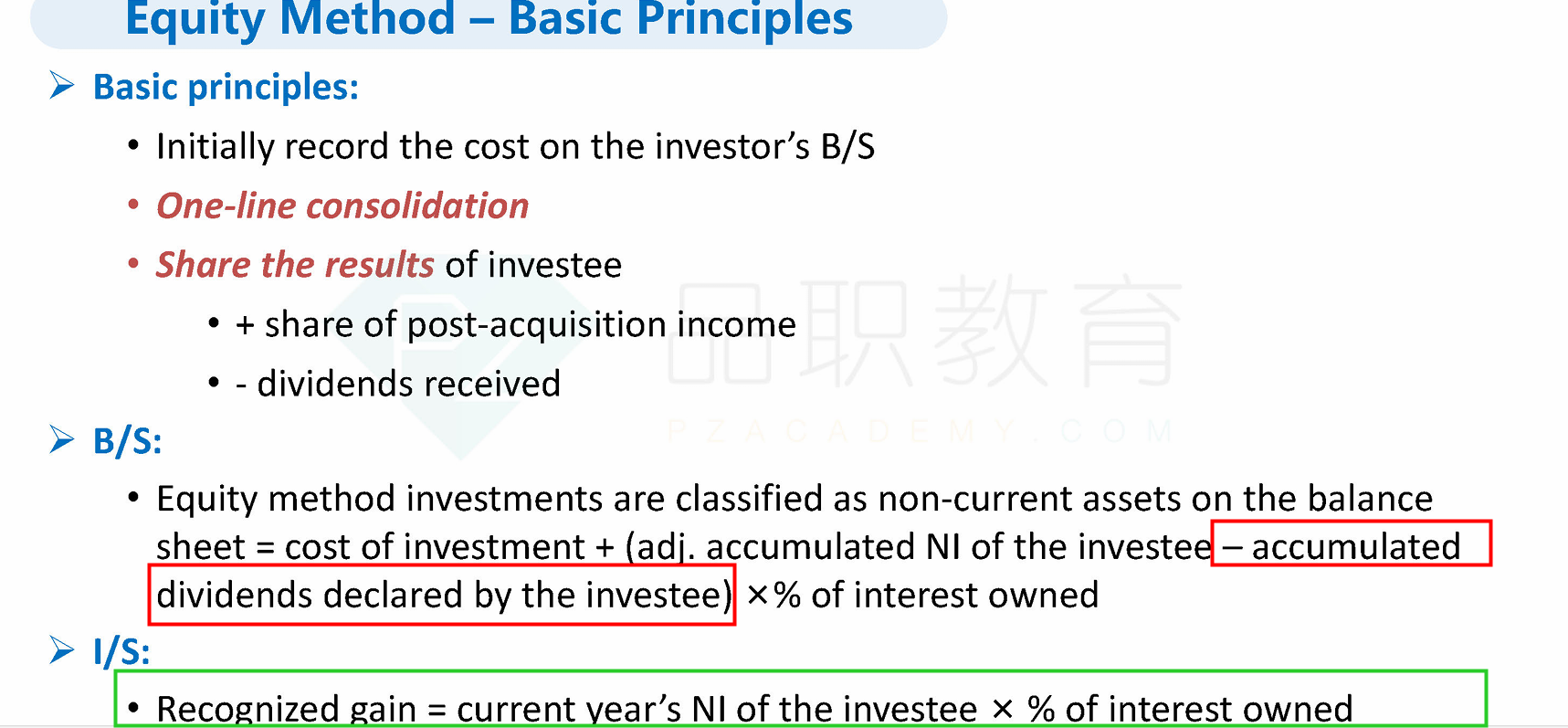

From the initial acquisition, Eagle’s share of the unrecorded identifiable intangible assets is $60 million × 20% = $12 million. This amount will have to be amortized against investment income over its useful life of 10 years (12/10 = 1.2 per year).

老师好,如果题目问的是B/S中的investment in associate,那么为什么计算的时候没用上题目里的Dividend paid呢?Dividend不会影响到I/S但是会反映在B/S中,请问这个理解有问题吗? xiaminyige下面一个小题里就题干的问题一样,只是换了fairvalue method就算上了dividend