NO.PZ2023091802000121

问题如下:

A 1-year forward contract on a stock with a forward price of USD 100

is available for USD 1.50. The table below lists the prices of some barrier

options on the same stock with a maturity of 1 year and strike of USD 100.

Assuming a continuously compounded risk-free rate of 5% per year what is the

price of a European put option on the stock with a strike of USD 100.

Option Price

Up-and-in barrier call, barrier USD 95 USD 5.21

Up-and-out barrier call, barrier USD 95 USD 1.40

Down-and-in barrier put, barrier USD 80 USD 3.5

选项:

A.

USD 2.00

B.USD 4.90

C.USD 5.11

D.USD 6.61

解释:

The sum of the price of up-and-in barrier call and up-and-out

barrier call is the price of an otherwise the same European call. The price of

the European call is therefore USD 5.21 + USD 1.40 = USD 6.61. The put-call

parity relation gives Call – put = Forward (with same strikes and maturities).

Thus 6.61 – put = 1.50. Thus put = 6.61 – 1.50 = 5.11

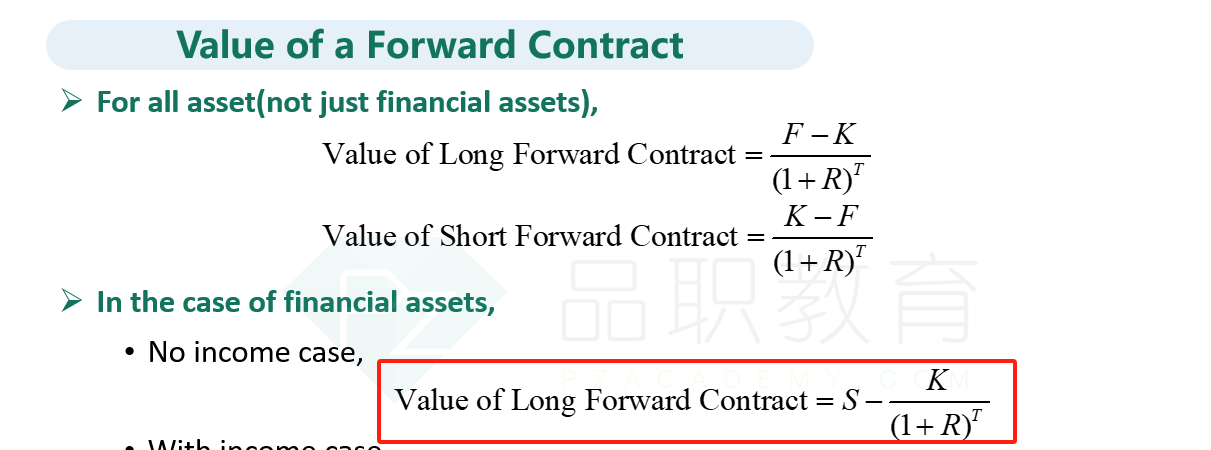

有远期合约的put call parity不应该是p+pv(f)=c+pv(x)吗,为什么这道题不需要考虑pv(x)?