NO.PZ202309050200000104

问题如下:

What is a significant difference between the limited partners of DAG LP and the outside shareholders of DAG Inc.?

选项:

A.Managerial responsibilities

Taxation of income from the partnership

The ability to vote and replace members of the DAG Inc. board of directors

解释:

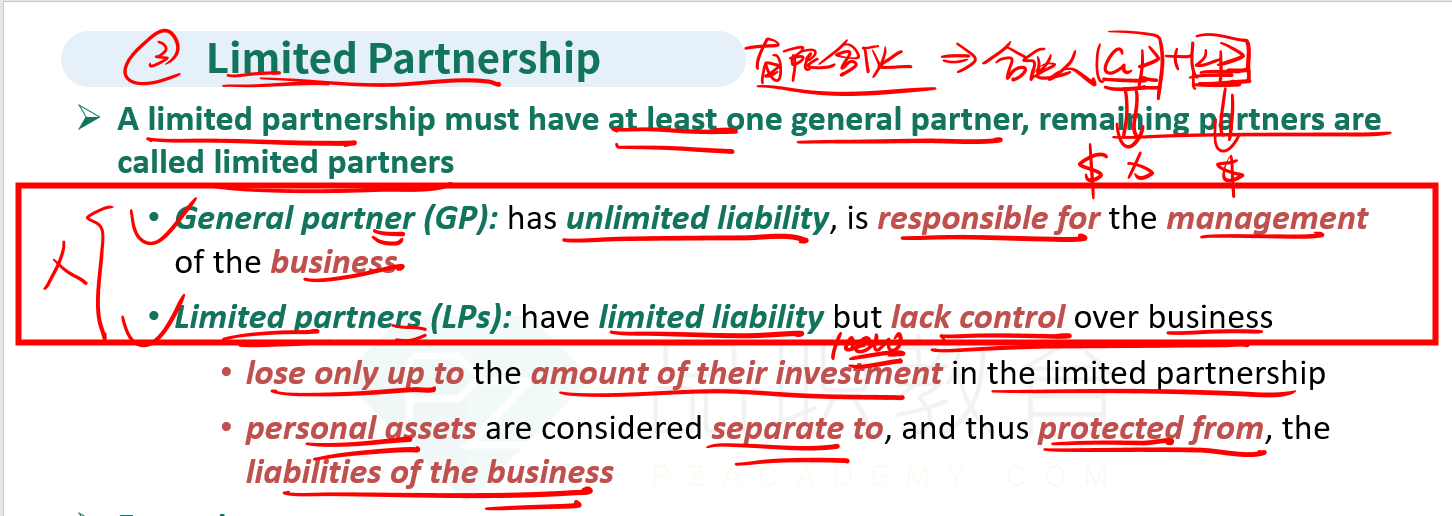

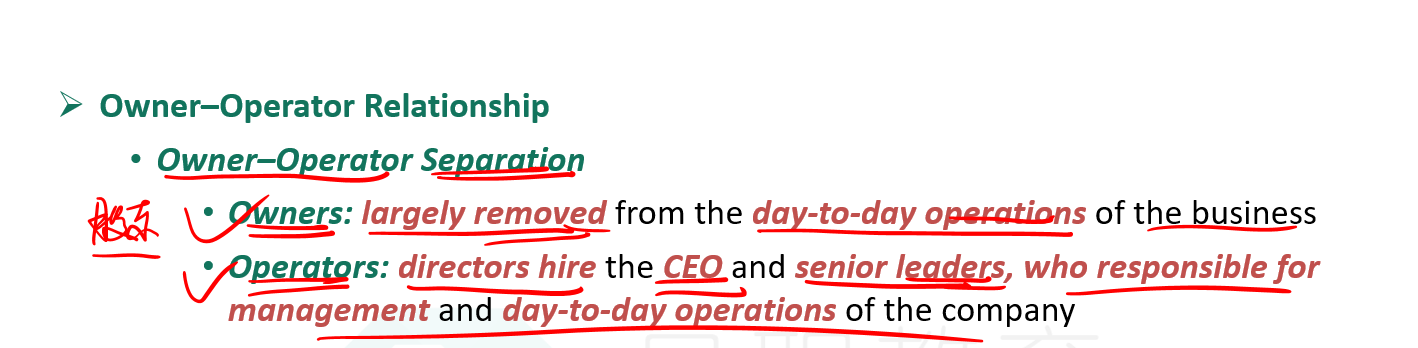

C is correct. The limited partners of DAG LP are not shareholders of DAG Inc., so they do not have voting rights in the corporation. Additionally, because the limited partners own only 20% of the partnership, they also have little ability to remove DAG Inc. as the general partner. In contrast, outside shareholders own 70% of DAG Inc. and have voting rights. They could use their collective ownership to effect change in the management of DAG Inc.

A is incorrect. Neither the DAG LP limited partners nor the outside shareholders of DAG Inc. have managerial responsibilities. The general partner has managerial responsibilities of the partnership, and the board of DAG Inc. has managerial responsibilities of the corporation.

B is incorrect. Owing to the special corporate form of DAG Inc., both the corporation and the limited partnership are pass-through entities. Therefore, neither the partnership nor the corporation pays entity-level income taxes, but both the limited partners and shareholders are responsible for personal income taxes.

能解释下这道大题吗