NO.PZ2023091802000057

问题如下:

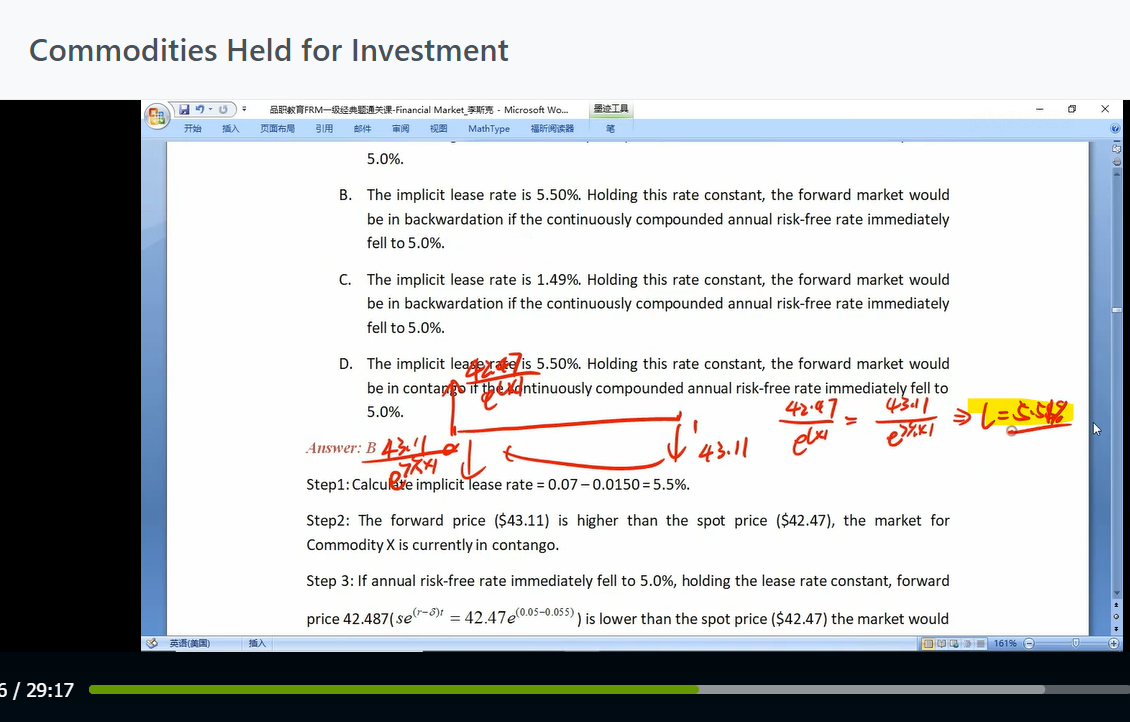

The current price of Commodity X in the spot market is $42.47. Forward contracts for delivery of Commodity X in one year are trading at a price of $43.11. If the current continuously compounded annual risk-free interest rate is 7.0%, calculate the implicit lease rate for Commodity X. Holding the calculated implicit lease rate constant, would the forward market for Commodity X be in backwardation or contango if the continuously compounded annual risk-free rate immediately fell to 5.0%?

选项:

A.The implicit lease rate is 1.49%. Holding this rate constant, the forward market would be in contango if the continuously compounded annual risk-free rate immediately fell to 5.0%.

B.The implicit lease rate is 5.50%. Holding this rate constant, the forward market would be in backwardation if the continuously compounded annual risk-free rate immediately fell to 5.0%.

C.The implicit lease rate is 1.49%. Holding this rate constant, the forward market would be in backwardation if the continuously compounded annual risk-free rate immediately fell to 5.0%.

D.The implicit lease rate is 5.50%. Holding this rate constant, the forward market would be in contango if the continuously compounded annual risk-free rate immediately fell to 5.0%.

解释:

Step1: Calculate implicit lease rate = 0.07 – 0.0150 = 5.5%.

Step2: The forward price ($43.11) is higher

than the spot price ($42.47), the market for Commodity X is currently in

contango.

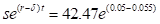

Step 3: If annual risk-free rate immediately

fell to 5.0%, holding the lease rate constant, forward price

is lower than the spot price ($42.47) the market would be

in backwardation.

此题lease rate 和讲义中的公式不一样,解析是“Calculate implicit lease rate = 0.07 – 0.0150 = 5.5%.‘’怎么理解?