NO.PZ201809170400000405

问题如下:

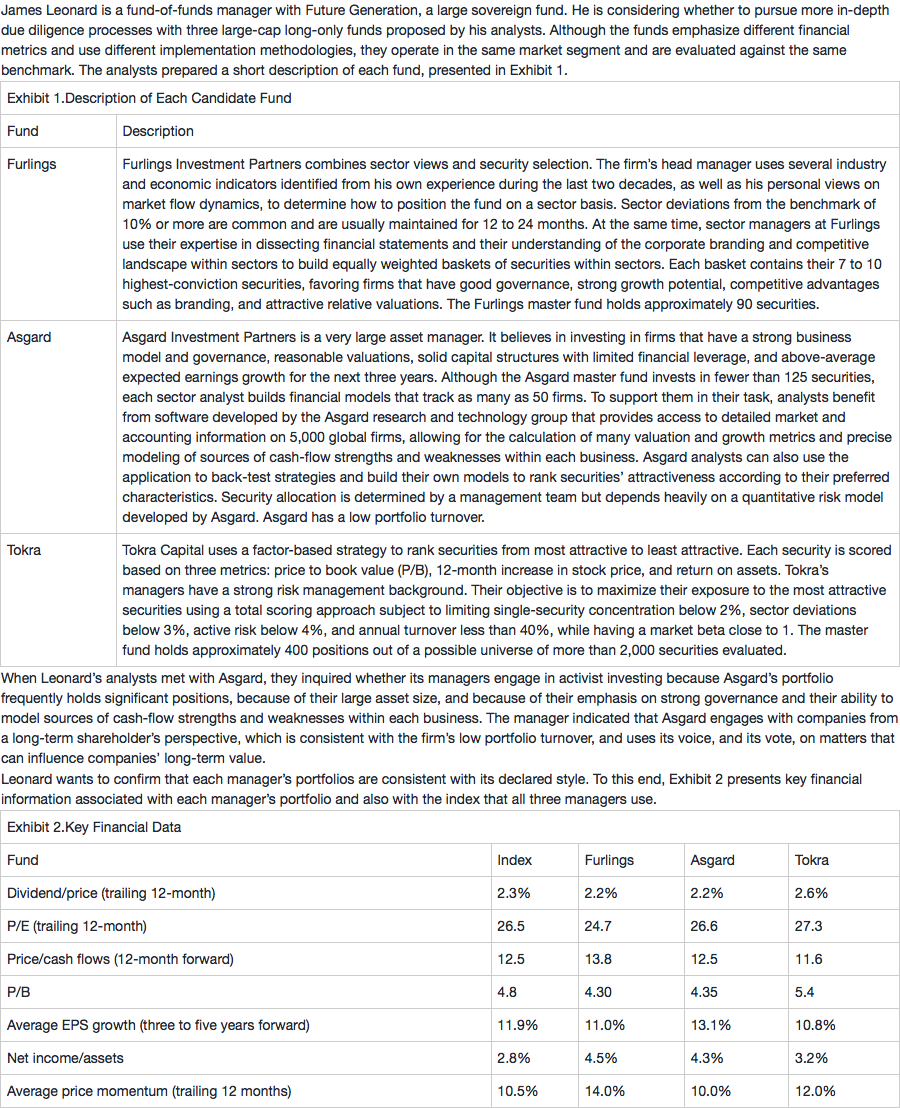

Based on the information provided in Exhibits 1 and 2, which manager’s portfolio characteristics is most likely at odds with its declared style?

选项:

A.

Furlings

B.

Asgard

C.

Tokra

解释:

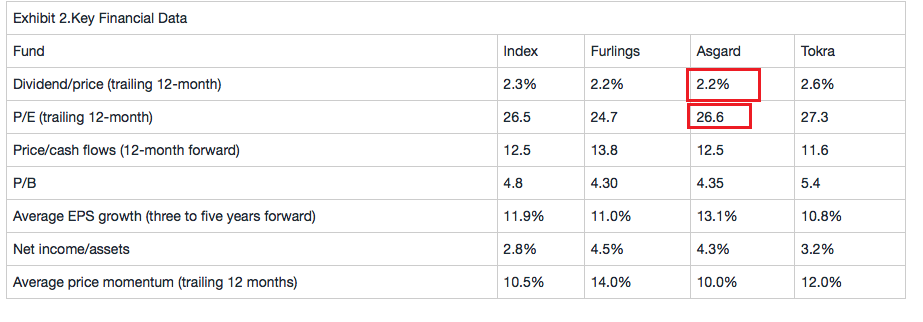

C is the correct answer. Tokra indicates that it emphasizes three metrics: P/B, 12-month price momentum, and return on assets. Although the portfolio consists of securities that have stronger momentum than those of the index on average, and although the ratio of net income to assets is also favorable, the average P/B is somehow higher than that of the index. Although this scenario could normally be explained by an emphasis on specific sectors with a higher P/B than other sectors, the low level of sector deviation tolerated within the strategy weakens that explanation. This should be explored with Tokra’s managers.

A is an incorrect answer. Furlings is a top-down sector rotator with a value orientation within sectors. The lower P/B and P/E and higher net income over assets are consistent with a relative value orientation. Because Furlings can take significant positions in specific sectors, however, there could be other circumstances in which the portfolio would have a higher P/B and/or P/E and or a lower net income /assets than the index if the fund were to emphasize sectors having such characteristics. Yet, this would not necessarily imply that the firm does not favor the most attractive relative valuations within sectors.

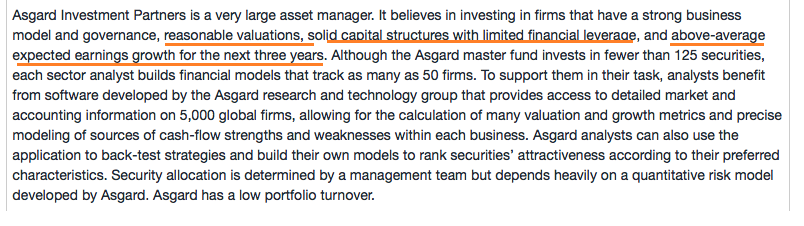

B is an incorrect answer. Asgard invests in firms that offer reasonable valuations and above average expected cash flow growth during the next three years. The data, such as P/B and average expected three-year profit growth, are consistent with its declared style. Again, it is not necessarily inconsistent to emphasize these aspects while investing in a portfolio that has a lower dividend yield, slightly higher P/E, and lower price momentum.

能否中文解释下,没太理解