NO.PZ2023032701000019

问题如下:

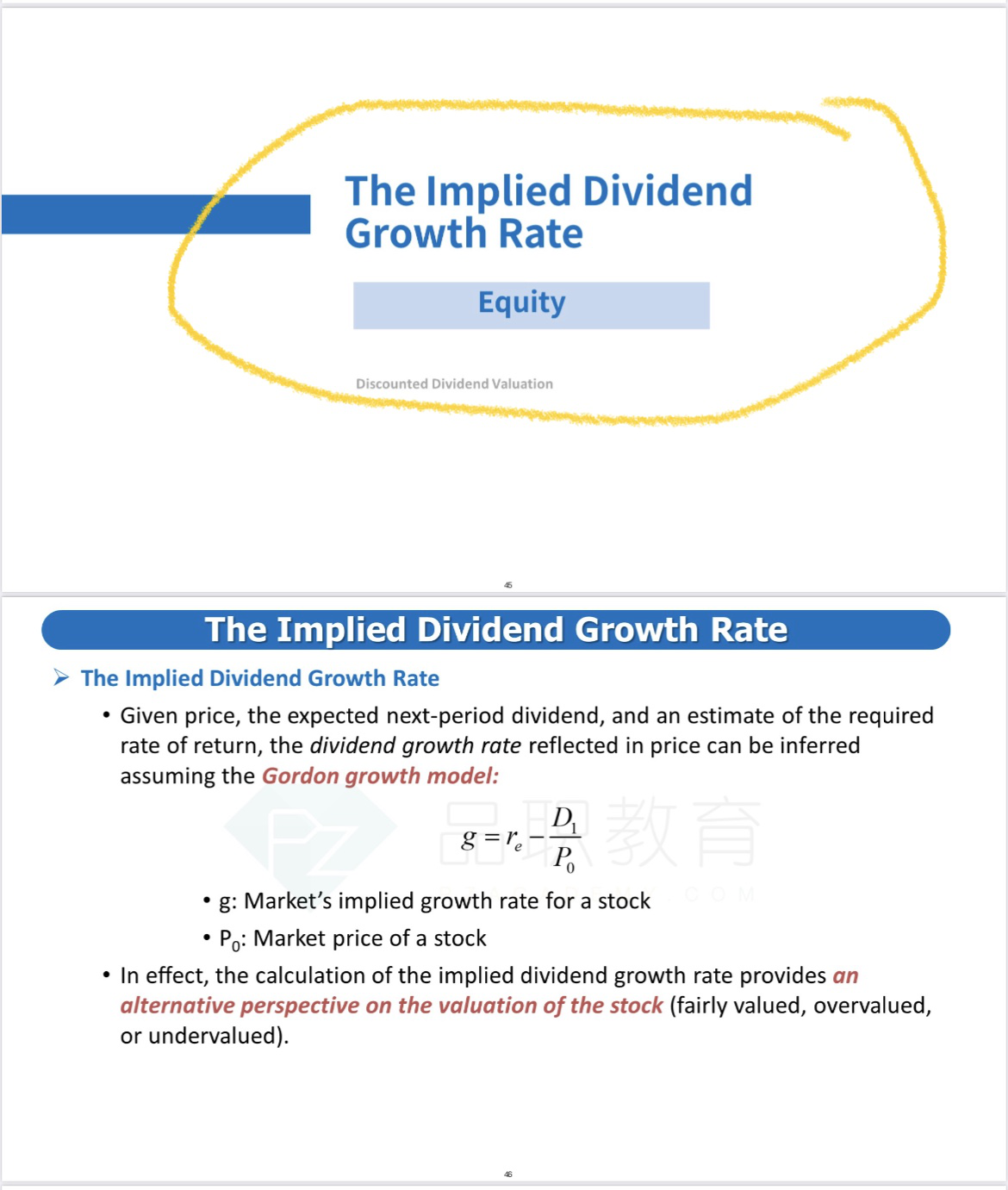

Tanner expects short-term rapid earnings growth of 20% in 2014 for GNSK, with the rate of growth linearly diminishing over the next five years to match industry conditions thereafter. He assumes that starting in Year 6, GNSK’s long-term dividend growth rate will be equal to the current level of implied growth rate for the industry. Given these assumptions and the data in Exhibit 1.

Using Bradley’s assumptions regarding GNSK and the data from Exhibit 1, GNSK’s long-term dividend growth rate is closest to:

选项:

A.8.0%

7.0%

7.3%

解释:

0.037 = (0.11 – g)/(1 + g)

0.037(1 + g) + g = 0.11

0.037 + 0.037g + g = 0.11

1.037g = 0.11 – 0.037

g = 0.073 / 1.037 = 0.0704 =7.0%

为何此处的imply g和行业ROE*b得出来的g有什么联系吗,或两者可以等同吗?