NO.PZ2016012102000192

问题如下:

If a firm recognized an impairment of its long-lived depreciable asset in this year, which of the following statement would be least appropriate?

选项:

A.

The recognition would decrease the pretax income in this year.

B.

The recognition would not change the tax payable in this year.

C.

The recognition would increase the COGS in this year.

解释:

C is correct.

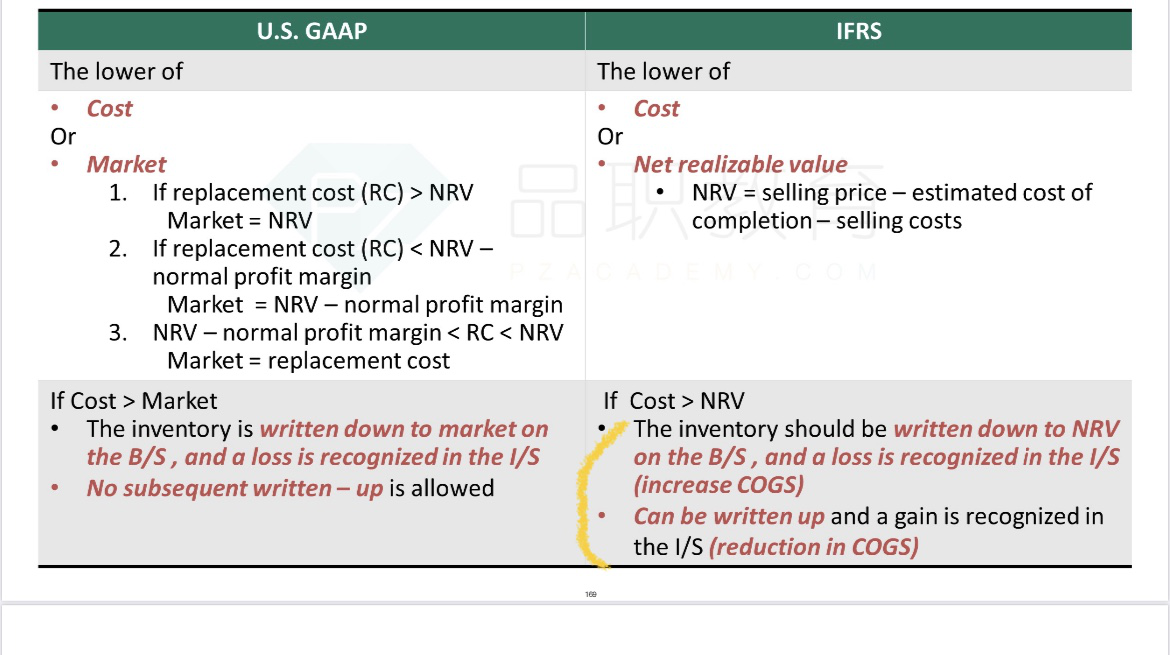

Impairment charges should be recognized as a loss before tax rather than an increase of COGS---an item would be recgnized in the inventory writedown.

The taxpayable would only be changed when the loss was realized.

考点: 资产减值,tax reporting & financial reporting

当期发生的资产减值应确认为税前的损失,影响税前利润(pretax income)。资产减值,与存货减值不同,不会增加销售成本(COGS)

应纳税所得额计算中,只有考虑实际已经发生的损失。(资产减值只在资产出售时,才会被税务局确认为损失,影响当期应纳税所得额)

存货减值损失会影响COGS?中国的准则是不是不影响COGS,因为分录是 借 资产减值损失 贷存货跌价准备