NO.PZ2023040201000084

问题如下:

The following performance data are provided for an alternative investment.

选项:

A.0.46. B.0.61. C.0.65.解释:

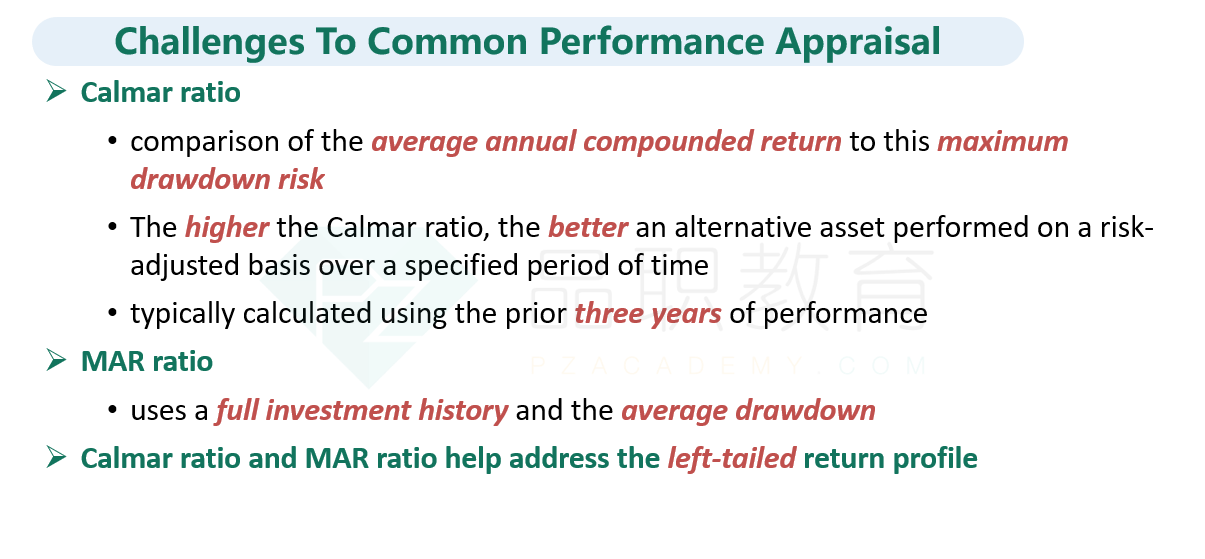

B is correct. The Calmar ratio is typically calculated using the prior three years of performance and is a comparison of the average annual compounded return to its maximum drawdown risk. For this particular investment, the Calmar ratio is calculated as follows: 6.2% (average compounded return over the past three years)/10.2% (maximum drawdown) = 0.60784 ≈ 0.61.Calmer ratio的分母是the average compounded annual return rate over a period 我理解,但是为什么用的是6.2,我用geometric mean求了5.4左右的数,也想过要不要用since initiation的4.4,实在没想到用3年期的6.2