NO.PZ201812100100000701

问题如下:

Which of Webster’s notes about BIG Industrial provides an accounting warning sign of a potential reporting problem?

选项:

A.

Only Note 1

B.

Only Note 2

C.

Both Note 1 and Note 2

解释:

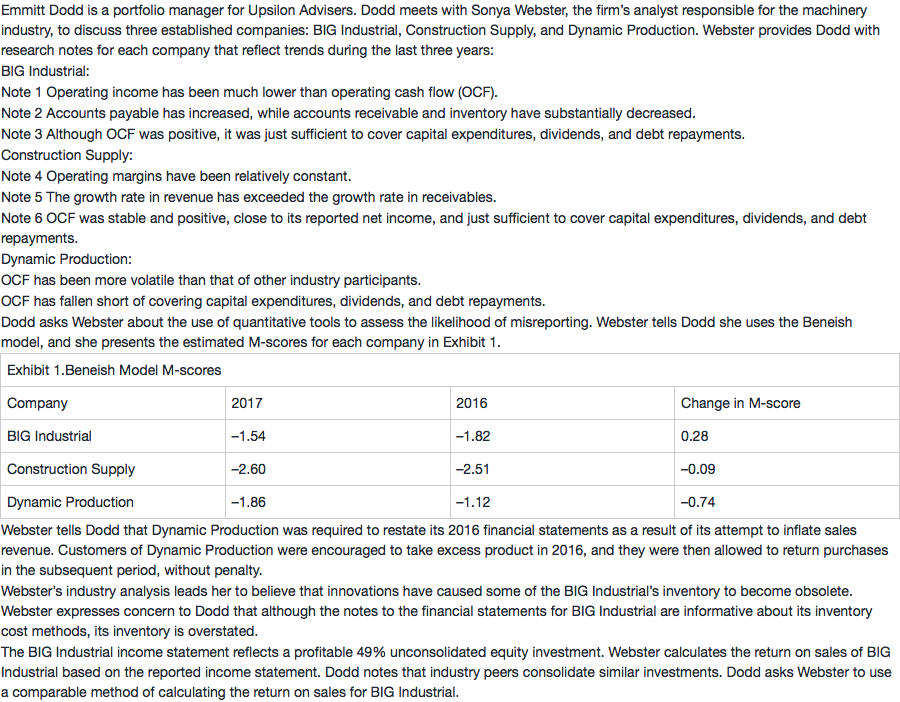

B is correct.

Only Note 2 provides a warning sign. The combination of increases in accounts payable with substantial decreases in accounts receivable and inventory are an accounting warning sign that management may be overstating cash flow from operations. Note 1 does not necessarily provide a warning sign. Operating income being greater than operating cash flow is a warning sign of a potential reporting problem. In this case, however, BIG Industrial’s operating income is lower than its operating cash flow.

解析:Note 2是warning sign。A/P增加,同时A/R和inventory大幅下降,有可能高估CFO(=NI+dep-ΔINV-ΔAR+ΔAP)。Note 1不是warning sign,但如果反过来:operating income比operating cash flow大,那么就是warning sign。

如果AR 和Inventory 都大幅下降,那说明delta AR 和delta Inventory 都会是比较大的值,Delta AP 是比较小的值,这样算出来的CFO 是比较小的,为什么说会高估CFO 呢?