NO.PZ2023041003000016

问题如下:

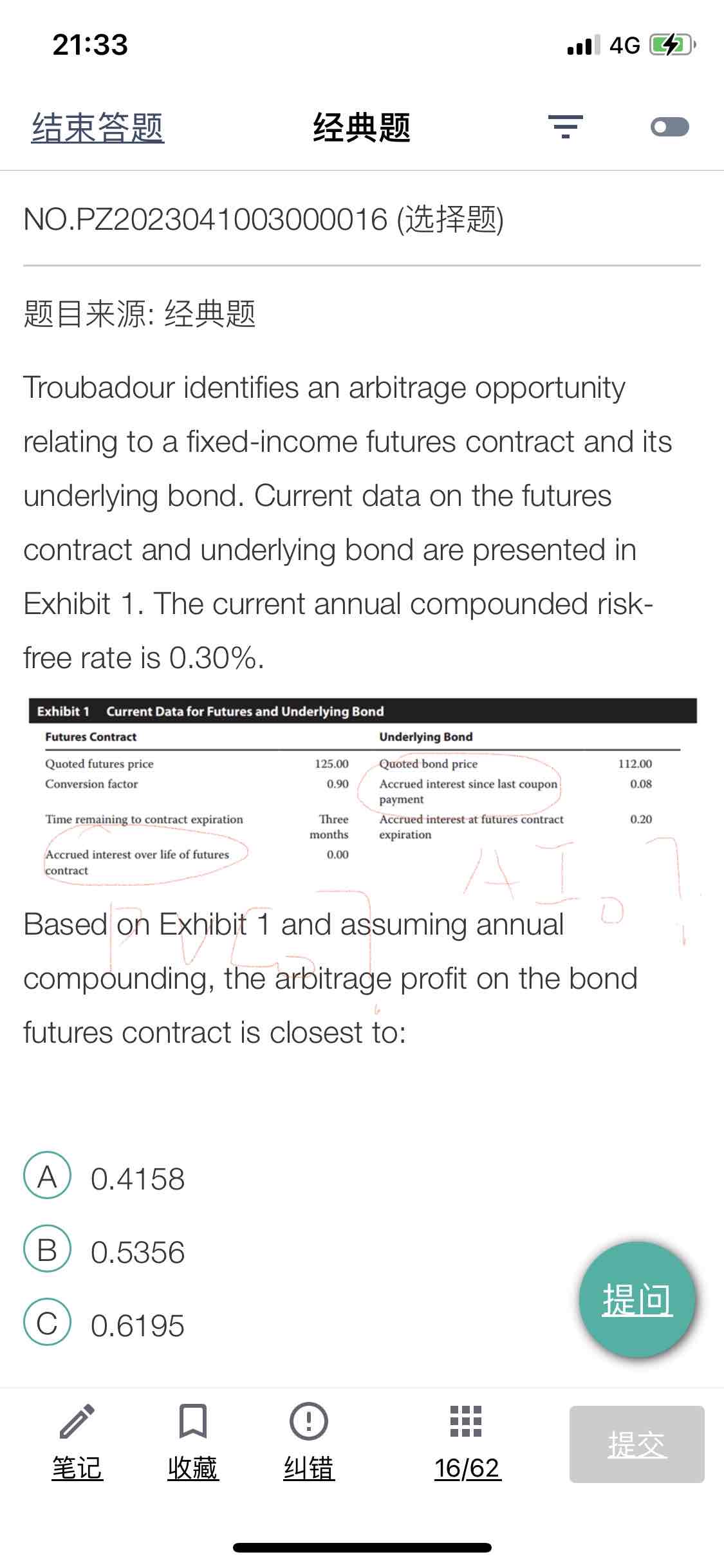

Troubadour identifies an arbitrage opportunity

relating to a fixed-income futures contract and its underlying bond. Current

data on the futures contract and underlying bond are presented in Exhibit 1.

The current annual compounded risk-free rate is 0.30%.

Based on Exhibit 1 and assuming annual compounding, the arbitrage

profit on the bond futures contract is closest to:

选项:

A.

0.4158

B.

0.5356

C.

0.6195

解释:

The no-arbitrage futures price is equal to the

following:

F0(T) =FV0,T(T)[B0(T + Y) +Al0– PVCI0,T]

F0(T)= (1 + 0.003)0.25(112.00 + 0.08 - 0)

F0(T) = (1

+ 0.003)0.25 (112.08) = 112.1640

The adjusted price of the futures contract is

equal to the conversion factor multiplied by the quoted futures price:

F0(T)=CF(T)QF0(T)

F0(T) = (0.90)(125) = 112.50

Adding the accrued interest of 0.20 in three

months (futures contract expiration) to the adjusted price of the futures

contract gives a total price of 112.70.

This difference means that the futures contract

is overpriced by 112.70 - 112.1640 = 0.5360. The available arbitrage profit is

the present value of this difference: 0.5360/(1.003)0.25= 0.5356.

为什么这俩英文代表AI0和PVC0?尤其over life那个,只字不见coupon,就能看出来是PVC0了?我还以为last coupon payment是PVC0了,至少还带个coupon的字样。