private real estate 和stock xiang相比,答案是风险更小,return也更小。

可是在portfolio里面关于credit premium那章,commercial real estate 作为最后一种投资产品,其premium=1+lta+theta+pi+lamda+liquidity premium,这不说明房地产比股票要求hu回报率更高吗?

谢谢老师

韩韩_品职助教 · 2018年06月09日

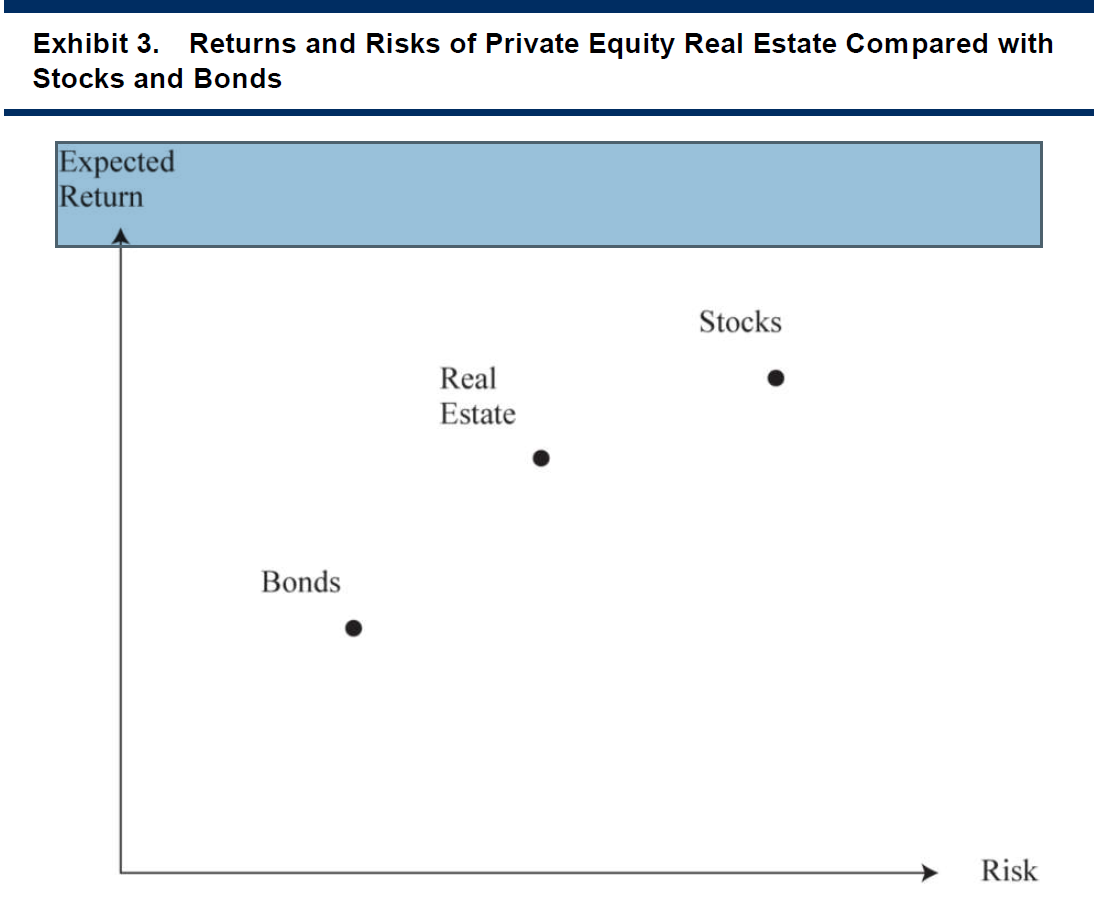

同学你好,这里的思考角度主要是real estate既有bond的属性,又要stock的属性,所以整体来看它的return和risk都是处在两种产品中间的。

The structure of leases between the owner and tenants also affects risk and return. leases can be thought of as giving equity real estate investment a bond-like characteristic because the tenant has a legal agreement to make periodic payments to the owner. At the end of the lease term, however, there will be uncertainty as to whether the tenant will renew the lease and what the rental rate will be at that time. On balance, because of these two influences (bond-like and stock-like characteristics), real estate, as an asset class, tends to have a risk and return (based on historical data) profile that falls between the risk and return profiles of stocks and bonds.这是原版书的解释。