NO.PZ2023040501000063

问题如下:

In fiscal year 2012, the company will begin granting employees stock awards (SAs) rather than stock options as part of its executive compensation plans. SAs are grants that entitle the holder to shares of company stock as the award vests (normally a four-year period) with the award being based on accounting performance metrics as determined by the Compensation Committee of the Board of Directors.

In reviewing the change in the company’s executive compensation, MacPhail made the following three observations:

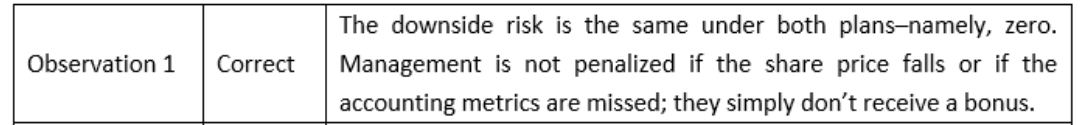

1. Management will have the same downside risk exposure from the stock awards plan as they currently face with the stock options plan.

2. Because both the stock awards and stock options have the same vesting period, they will also have the same total effect on net income.

3. The issuance of new shares under the new stock awards plan should improve the company’s debt/equity ratio.

Which of MacPhail’s observations about the new executive compensation plan is most accurate?

选项:

A.

1

B.

2

C.

3

解释:

去帮忙解释一下A为何对。谢谢。