NO.PZ2023020101000026

问题如下:

IST Risk Solutions provides institutional financial risk management

advisory and brokerage services. Clients seek IST’s services when evaluating

whether to hedge interest rate, currency, or equity market risks. Simon Weber,

senior adviser at IST, is discussing a new client with analyst Noel Franco.

Weber states: “Newport State College plans a $10 million

laboratory renovation for its science center and has engaged IST to implement

options strategies in order to manage the risk of rising interest rates. The

renovation is to be completed in 12 months, in time for the start of the school

year. To minimize disruption to its academic schedule, however, Newport will

not begin the work until six months from now. State funding will not be

received until the beginning of the next school year, so a six-month variable

interest rate loan will finance the renovation.”

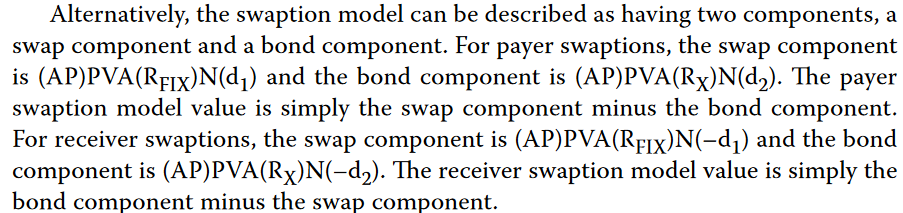

Weber comments: “We can also consider options on swaps,

which the Black model views as having a bond component and a swap component.

The swaption, used to hedge against rising interest rates, can be evaluated as

the swap component minus the bond component.”

Is Weber’s description of the swaption used for the hedge most likely correct?

选项:

A.No, because it

would be correctly evaluated as the bond component minus the swap component

No, because he

is describing a receiver swaption

C.

Yes

解释:

A payer swaption would hedge against rising interest rates. According

to the Black model, the

value of a payer swaption can be described as the swap component minus

the bond component.

B is

incorrect. A receiver swaption hedges against falling interest rates and Weber

is describing a payer swaption.

A is

incorrect. The receiver swaption is evaluated as the bond component minus the

swap component.

According to the Black model, the value of a payer swaption can be described as the swap component minus the bond component.

我看了之前同学的提问,按照老师的提示,我又重新看了一遍基础班视频,但是李老师没有讲bond component这一块啊,只有一个callable bond 貌似和这道题的知识点也不是重合的。请老师解读。

我对这道题的理解是,这个大学要在6个月后开展一个实验室的翻新工程,然后这个翻新工程将在12个月后完成。但是国家给的钱要12个月以后才付款,所以这个大学在六个月后需要借钱进行实验室翻新。因为担心利率上涨,所以这个大学要做一个swaption,也就是在未来六个月到12个月以内,付固定,所以是payer swaption(call on interest)。题干给的swap和bond我是怎么也不能带入到这个题目里,好奇怪的知识点。

请老师解读。