NO.PZ2023020101000023

问题如下:

Cummins states that long-/short-hedge fund

managers seek to identify and exploit any mispricing that may exist between the

price of an option and the price of its underlying stock, utilizing a

replicating strategy. Cummins asks Spelding to assess the three scenarios

outlined in Exhibit 2, based on the information in Exhibit 1 and assuming that

the price of a one-year European-style call option is $19.25.

Exhibit

1: Binomial Model Variables and Values

Exhibit

2: Scenarios and Replicating Strategies

With respect to the replicating

strategies, which scenario is most

likely correct:

选项:

A.Scenario

1.

Scenario

2.

C.

Scenario

3.

解释:

The

$19.25 price of the call option exceeds its value of $15.44, as calculated

based on both the no-arbitrage approach and the expectations approach.

Accordingly, the replicating strategy per 100 shares is to (1) sell 1 option, (2)

buy h shares, and (3) borrow h * (up/down factor price + up/down call payoff).

The

call option calculations follow:

•

No-arbitrage approach:

Hedge ratio

Call Option value

•

Expectations approach:

Probability of an up move π=0.45

Call Option value

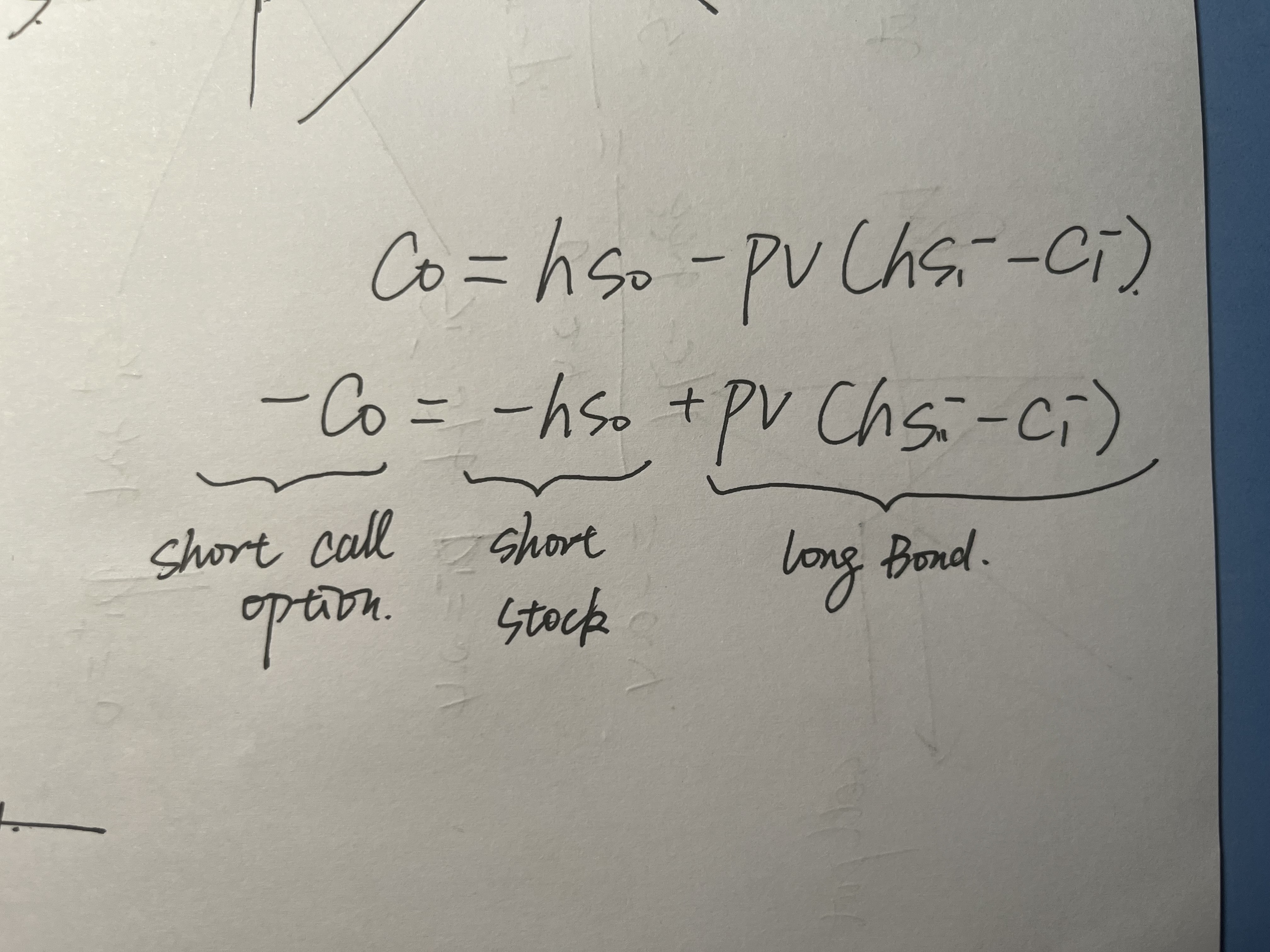

我看了之前老师回答的答案,

【根据无套利组合,每卖出1份call,需要long Δ份股票,因此我们long0.58份股票】

无套利组合是啥,这是李老师在哪里讲的知识点?

为什么不能用C+K=P+S?我最开始尝试用这个思考,发现算不出来。

我也用了老师讲的等式,如下图,推出的是卖出看涨期权【也就是题目所求的操作内容】,等于买空股票加买入债券,发现答案没有我的这个选项。请老师指出我错在哪里呢?