NO.PZ2016072602000048

问题如下:

The derivatives book of an international bank contains $300 million of notional value of interest rate swaps with $100 million each having remaining maturity of 0.5, 1.5 and 2.5 years. Their market value is $30 million. The book also has $300 million of foreign exchange swaps with a similar maturity profile and a market value of -$10 million. All counterparties are private corporations, so the risk weight is 100 percent. Calculate the credit equivalent amount under the original exposure method.

选项:

A.$18.5 million

B.$42 million

C.$35 million

D.$26 million

解释:

A is correct.

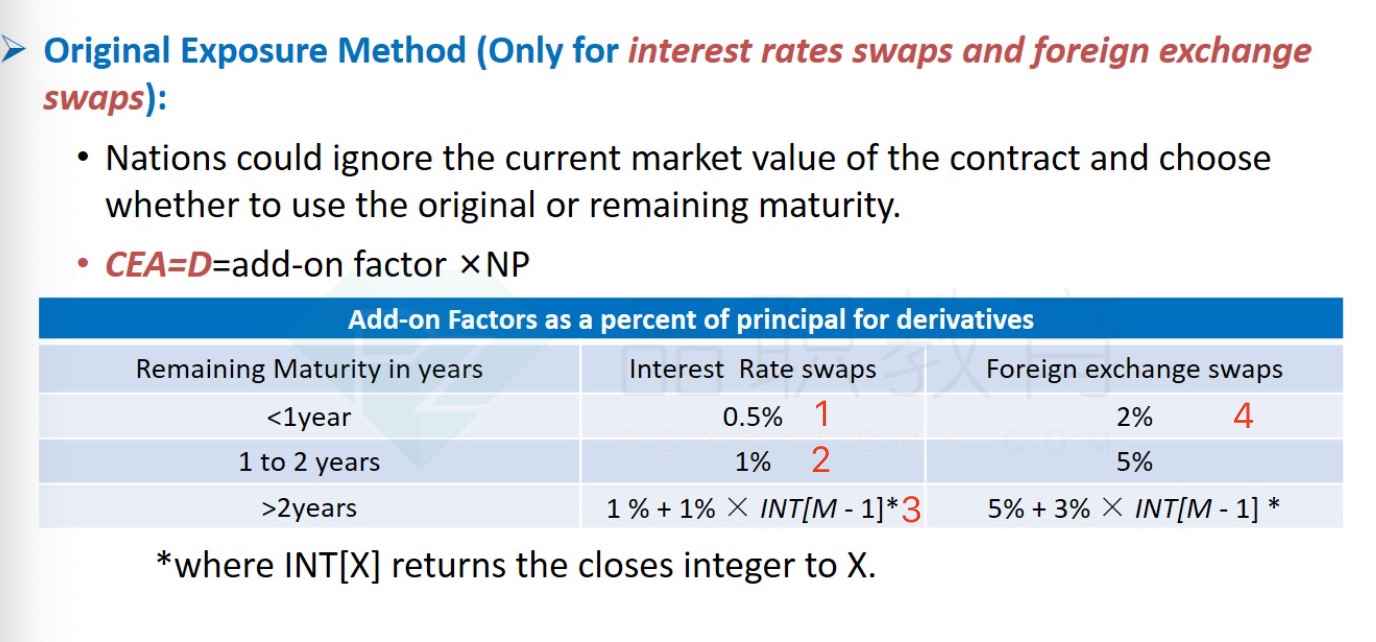

Under the original exposure method, it would be:

CEA=0.5% x 100+1%× 100+2%×100+2%×100+5%×100 +8%×100 = $18.5 million请问该类题目如何具体做呢,这些个系数是从哪里来的,ADD ON factor?该类题目如何计算VALUE 呢