NO.PZ2019070901000086

问题如下:

The derivatives book of an international bank contains $300 million of notional value of interest rate swaps with $100 million each having remaining maturity of 0.5, 1.5 and 2.5 years. Their market value is $30 million. The book also has $300 million of foreign exchange swaps with a similar maturity profile and a market value of -$10 million. All counterparties are private corporations, so the risk weight is 100 percent.Calculate the credit equivalent amount by Current Exposure Method.

选项:

A.18.5 million

B.42 million

C.28 million

D.35 million

解释:

B is correct.

考点:Risk Charge for derivatives

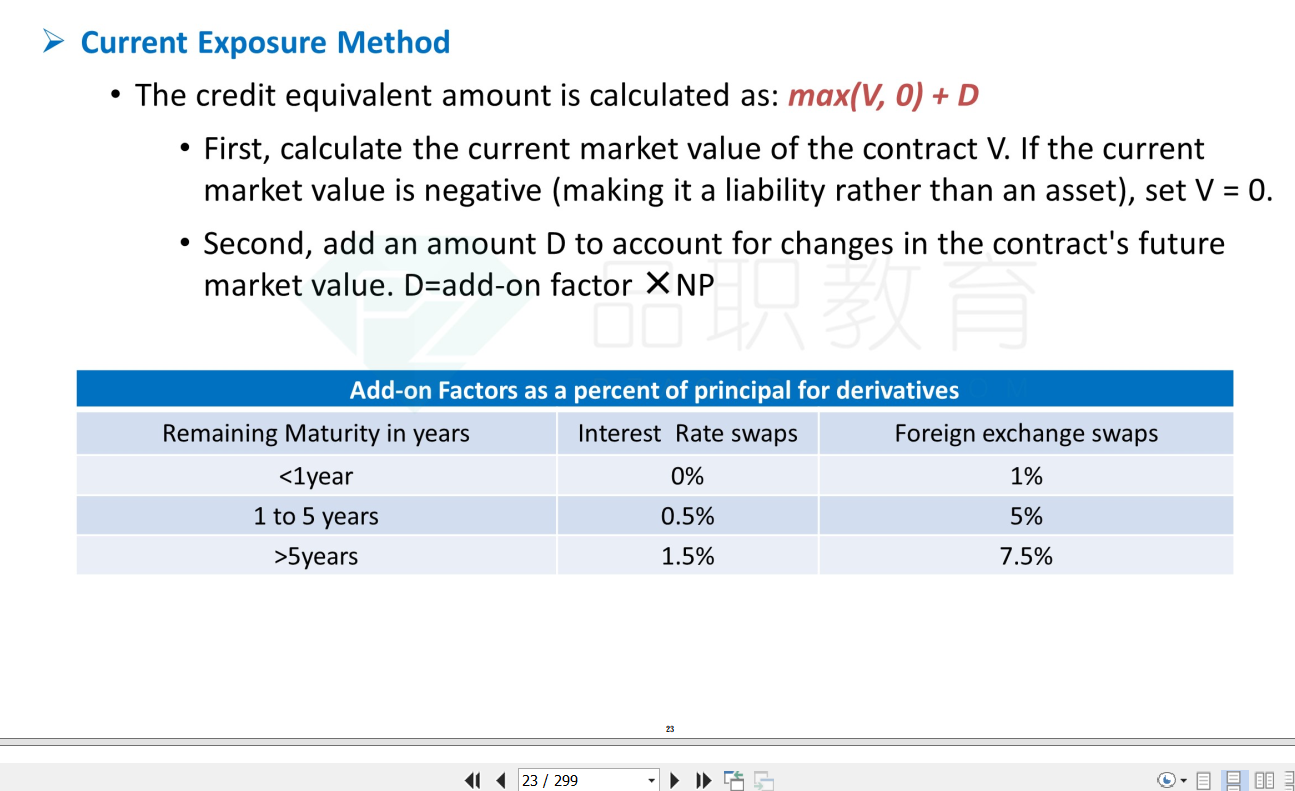

Under the current exposure method, the credit equivalent amount would be:

CEA=30+ 0%× 100 + 0.5%×200 + 1%× 100 + 5%×200 = $42 million

此题看不了明白,看了讲义还不明白,另外,啥是ADD ON FACTOR?此题目中给出的条件都怎么用呢?谢谢