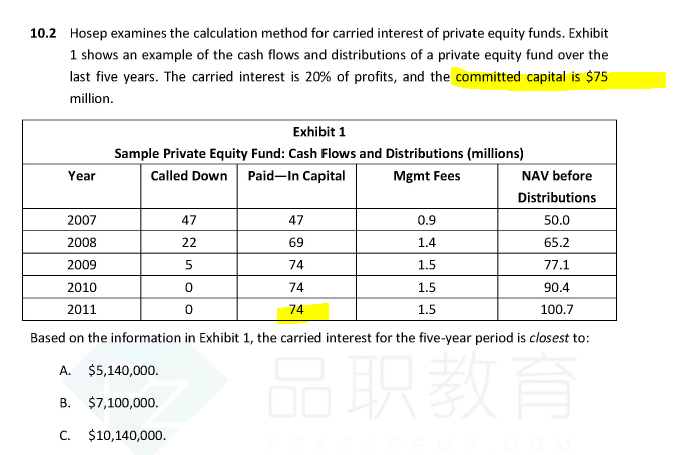

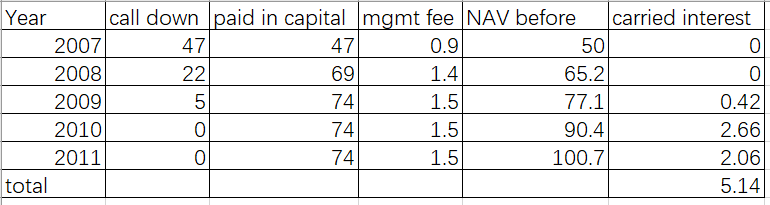

Calculate carried interest - when do you use committed capital and when do you use Paid in Capital?

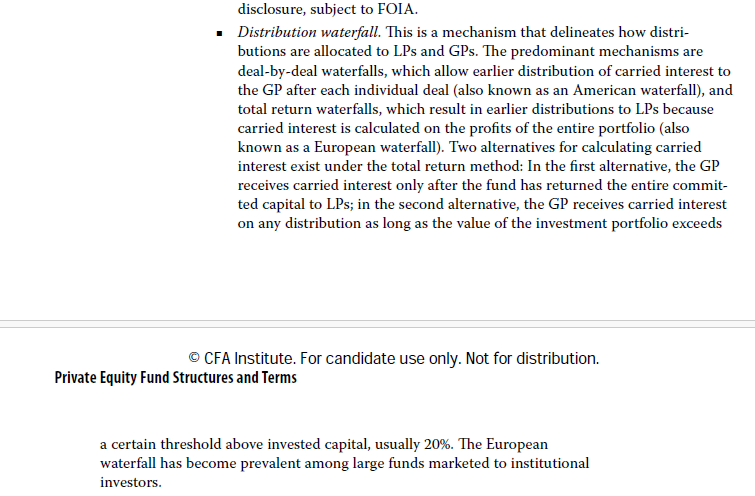

Because total return could be calculated through

(1) GP receives carried interest after the fund returns the entire committed capital to LP.

OR

(2) GP receives when the value of portfolio exceeds invested capital - so in this case aren't they talking about the cumulative paid-in capital?