NO.PZ2023032701000038

问题如下:

Ryan Leigh is preparing a presentation that analyzes the valuation of the common stock of two companies under consideration as additions to his firm’s recommended list, Emerald Corporation and Holt Corporation. Leigh has prepared preliminary valuations of both companies using a FCFE model and is also preparing a value estimate for Emerald using a dividend discount model. Holt’s 2007 and 2008 financial statements, contained in Exhibits 1 and 2, are prepared in accordance with US GAAP.

Exhibit 1.Holt Corporation Consolidated Balance Sheets (US$ Millions)

Exhibit 2.Holt Corporation Consolidated Income Statement for the Year Ended 31 December 2008 (US$ Millions)

Holt’s FCFE (in millions) for 2008 is closest to:

选项:

A.

$175

B.

$250

C.

$364

解释:

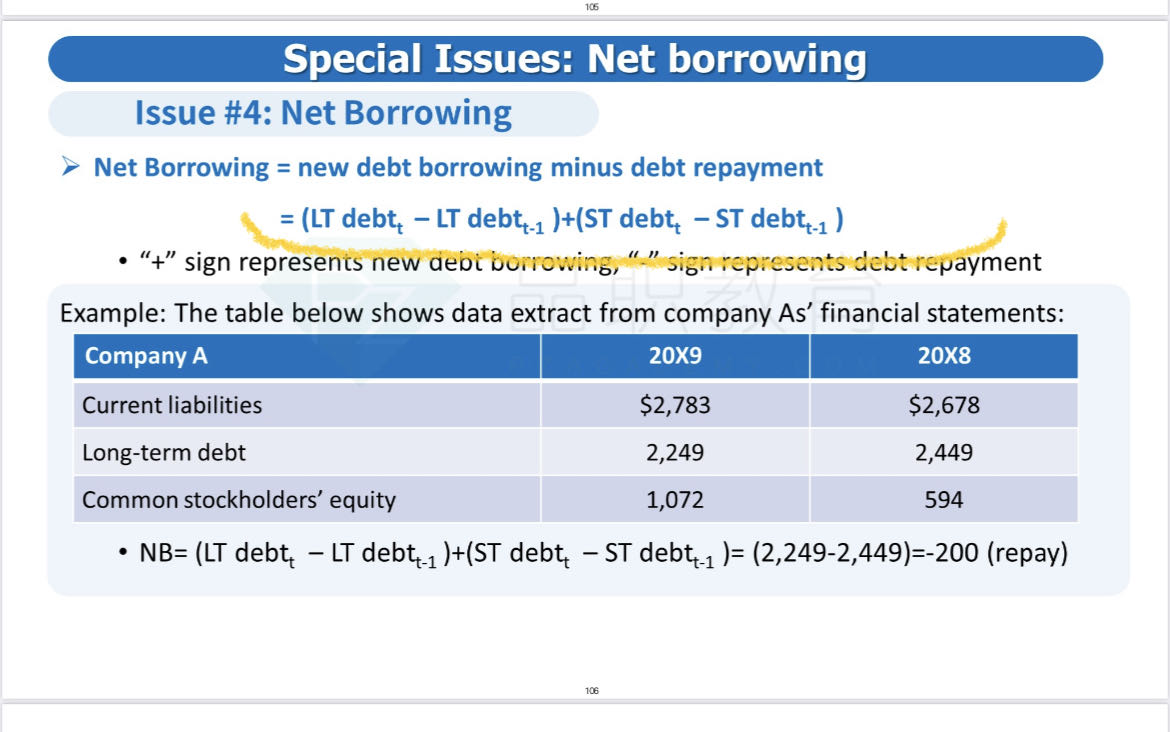

FCFE = NI + NCC – FCInv – WCInv + Net borrowing. In this case:

NI = $485 million

NCC = Depreciation expense = $270 million

FCInv = Net purchase of fixed assets = Increase in gross fixed assets= 4,275 -3,752 = $523 million

WCInv = Increase in accounts receivable + Increase in Inventory-Increase in accounts payable –Increase in accrued liabilities

= ( 770-711 ) + ( 846-780 ) - ( 476-443 ) - ( 149-114 )

= $57 million

Net borrowing = Increase in notes payable + Increase in long-term debt

= ( 465-450 ) + ( 1,575-1,515 ) = $75 million

FCFE = 485 + 270 - 523 - 57 + 75 = $250 million

An alternative calculation is

FCFE = FCFF –Int(1 – Tax rate) + Net borrowing

FCFE = 307.6 – 195(1 – 0.32) + (15 +60) = $250 million

我真服了!!!!!!

1.怎么notes payable又算是ST了?????它不是包含在CL里的吗????前一道题刚做的NB只包含了long term debt,因为CL只给了一个总数,没给细项。

2.ST到底都有什么啊????在资产负债表里没有一个叫做short term debt的单独项目列示?

3.如果ST没有单独项目列示的话,为什么长期debt有叫做long term debt的单独项目?

4.这些东西上课又都没有讲啊!!!!不是说上课必须要讲这么细,关键是这些细致的点是完全会关系到这题做不做的对。除非要说这个点大概率不会这么考也行,那么问题又来了,不考放在经典题这里干什么???制造焦虑???