NO.PZ202208220100000507

问题如下:

Your second-round interview for the Junior Quantitative Analyst position went well, and the next day, you receive an email from the investment firm congratulating you for making it this far. You are one of four remaining candidates from more than 100 who applied for the position. Because the position involves quantitative analysis, you are given an assignment to complete within 72 hours. You are provided a dataset and tasked with creating two logistic regression models to predict whether an ETF will be a “winning” fund, that is, whether the ETF’s monthly return will be one standard deviation or more above the mean monthly return across all ETFs in the dataset, or whether the ETF will be an “average” fund.

The variables in the dataset are as follows:

For the first logistic regression, you are asked to use all the independent variables, except for the fund size dummy variables (small_fund and medium_fund). For the second logistic regression, you are asked to use all the independent variables except the fund size continuous variable (net assets).

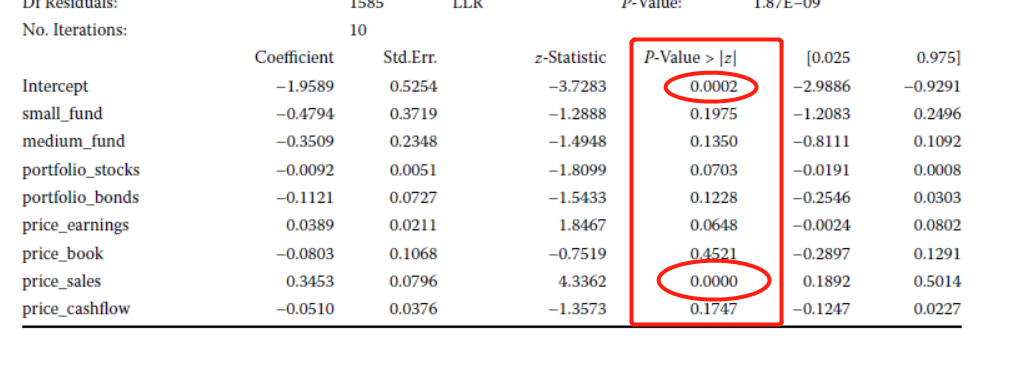

You use a standard software package (in Python or R) to develop the logistic regression models. Your results are as follows:

Determine, using the significant variable(s) in Logistic Regression 2 and the information provided, which of the following is closest to the probability of the Alpha ETF being a winning fund and whether it would be classified as a winning fund.

Alpha ETF variable values: small_fund = 0, medium_fund = 0, portfolio_stocks= 99.3%, portfolio_bonds = 0.7%, price_earnings = 25.0, price_book =1.1, price_sales = 4.0, and price_cashflow = 5.7.

Use significance level of 5% and probability threshold for being a winner of 65%.

选项:

A.27.4%, and the Alpha ETF is not classified as a winning fund B.36.0%, and the Alpha ETF is not classified as a winning fund C.82.2%, and the Alpha ETF is classified as a winning fund解释:

B is correct. Besides the significant intercept, the only significant (at 5% level) variable in Logistic Regression 2 is price_sales. Using these factors, the probability of this ETF being a winning fund is calculated to be 35.95%, as follows:

Because this probability is well below the 65% threshold for being a winner, the Alpha EFT would not be classified as a winning fund.

请问这道题讲解视频链接