NO.PZ2023032701000104

问题如下:

You have been asked to value Pacific Corporation, Inc., using an excess earnings method, given the following information:

• Working capital balance = $2,000,000

• Fair value of fixed assets = $5,500,000

• Book value of fixed assets = $4,000,000

• Normalized earnings of firm = $1,000,000

• Required return on working capital = 5.0 percent

• Required return on fixed assets = 8.0 percent

• Required return on intangible assets = 15.0 percent

• Weighted average cost of capital = 10.0 percent

• Long-term growth rate of residual income = 5.0 percent

Based on this information, the market value of invested capital is:

选项:

A.$12,330,000

$540,000

$4,830,000

解释:

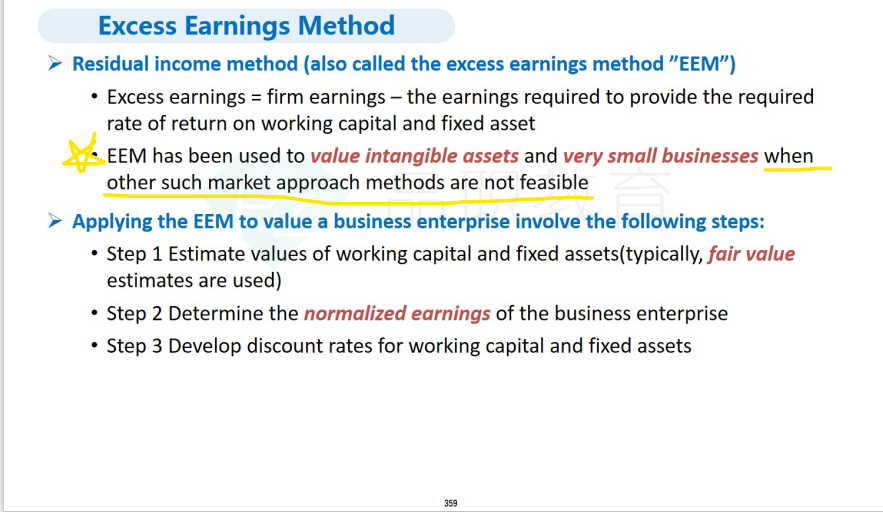

The excess earnings consist of any remaining income after returns to working capital and fixed assets are considered. Fair value estimates and rate of return requirements for working capital and fixed assets are provided. The return required for working capital is $2,000,000 × 5.0 percent = $100,000 and the return required for fixed assets is $5,500,000 × 8.0 percent = $440,000, or $540,000 in total.

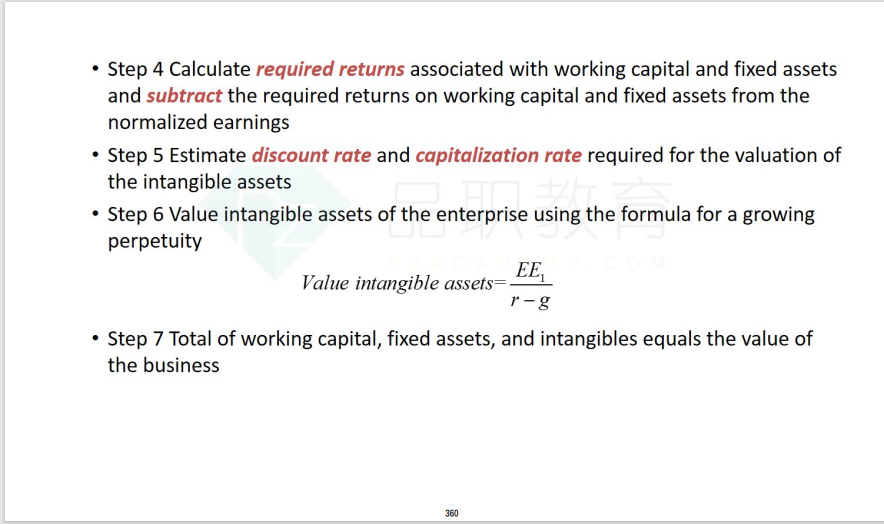

The residual income for intangible assets is $460,000 (the normalized earnings of $1,000,000 less the $540,000 required return for working capital and fixed assets). The value of intangible assets can then be calculated using the capitalized cash flow method. The intangibles value is $4,830,000 based on $483,000 of year-ahead residual income available to the intangibles capitalized at 10.0 percent (15.0 percent discount rate for intangibles less 5.0 percent long-term growth rate of residual income).

The market value of invested capital is the total of the values of working capital, fixed assets, and intangible assets. This value is $2,000,000+ $5,500,000 + $4,830,000 = $12,330,000.

The intangibles value 为什么不是=460000/15%?